CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Mar 28 2025 09:53

8 min

On Wednesday, April 2, the U.S. ADP Employment Change (13:15 GMT) is projected to rise to 90K, reflecting stable labour market conditions, while the U.K. Inflation Rate YoY (07:00 GMT) will indicate price pressures in the British economy. Thursday, April 3 sees the Swiss Inflation Rate YoY (07:30 GMT) potentially dipping into negative territory at -0.1%, alongside the Eurozone PPI YoY (10:00 GMT), expected to rise to 3.4%, hinting at producer-level inflationary pressures.

The week concludes on Friday, April 4, with crucial U.S. labour market data at 13:30 GMT, including the U.S. Unemployment Rate forecasted at 4.1%, Non-Farm Payrolls expected to decline to 80K, and Canada Employment Change anticipated to rebound to 30K. These figures will be pivotal in shaping expectations for Federal Reserve policy moves and broader market sentiment.

Here are the week’s key events:

Japan's retail sales for January rose 0.5% month-over-month (MoM), but the figure is expected to slow to 0.1% in February. The official data is set to be released on March 31 at 00:50 GMT. The anticipated slowdown in retail sales growth could be attributed to several factors, including weaker consumer spending following seasonal holiday shopping, rising living costs, and subdued wage growth. Additionally, uncertainty in global markets and the impact of a weaker yen may have dampened consumer confidence, leading to more cautious spending behavior in February.

(Japan Retail sales YoY Chart, Source: Trading Central)

Top US company earnings: -

The Reserve Bank of Australia (RBA) previously set its interest rate at 4.10%, and it is expected to remain unchanged in the upcoming decision on April 1 at 05:30 GMT. The expectation of a steady rate is likely driven by the RBA's cautious approach amid persistent inflationary pressures and economic uncertainty. While inflation has been gradually easing, it remains above the central bank’s target range, warranting a wait-and-see stance.

The Eurozone flash inflation rate for February stood at 2.3% year-over-year (YoY) and is expected to ease to 2.1% in March. The official data will be released on April 1 at 10:00 GMT. The anticipated decline in inflation can be attributed to several factors, including weaker energy price inflation, a gradual slowdown in core inflation components such as services and food, and the ongoing effects of the European Central Bank’s (ECB) restrictive monetary policy. With economic activity remaining subdued and wage growth stabilising, price pressures are expected to ease further, bringing inflation closer to the ECB’s 2% target over time.

(Eurozone Inflation Rate YoY Flash Chart, Source: Trading Central)

Top US company earnings: -

The U.S. ADP employment change for February came in at 77K, which is expected to increase to 90K in March. The data is scheduled for release on April 2 at 13:15 GMT. The projected rise in employment could be attributed to a rebound in hiring across key sectors such as leisure, hospitality, and healthcare, which have remained resilient despite broader economic uncertainties. Additionally, seasonal factors and a stable labour market may have contributed to stronger job creation. However, the increase remains modest, reflecting the impact of high interest rates and cautious business sentiment, which continue to weigh on overall hiring momentum.

(U.S. ADP Employment Change Chart, Source: Trading Central)

Top US company earnings: -

Switzerland's inflation rate YoY stood at 0.3% in February, but it is expected to decline to -0.1% in March. The official data will be released on April 3 at 07:30 GMT. The anticipated drop into negative territory could be driven by seasonal price adjustments, particularly in sectors like energy, transportation, and consumer goods. Additionally, Switzerland's traditionally low inflation environment, a strong Swiss franc reducing import costs, and subdued domestic demand may have contributed to downward price pressures.

(Swiss Inflation Rate YoY Chart, Source: Trading Central)

The Eurozone Producer Price Index (PPI) year-over-year (YoY) stood at 1.8% in January and is expected to rise to 3.4% in February. Meanwhile, the month-over-month (MoM) PPI was 0.8% in January, with a projected slowdown to 0.5% in February. The data is set for release on April 3 at 10:00 GMT.

The expected YoY increase suggests a resurgence in producer-level inflation, likely driven by rising energy and raw material costs, as well as supply chain adjustments. However, the slower MoM growth indicates a moderation in price pressures, reflecting stabilising input costs and weaker demand in some industrial sectors.

(Eurozone PPI YoY Chart, Source: Trading Central)

Top US company earnings: -

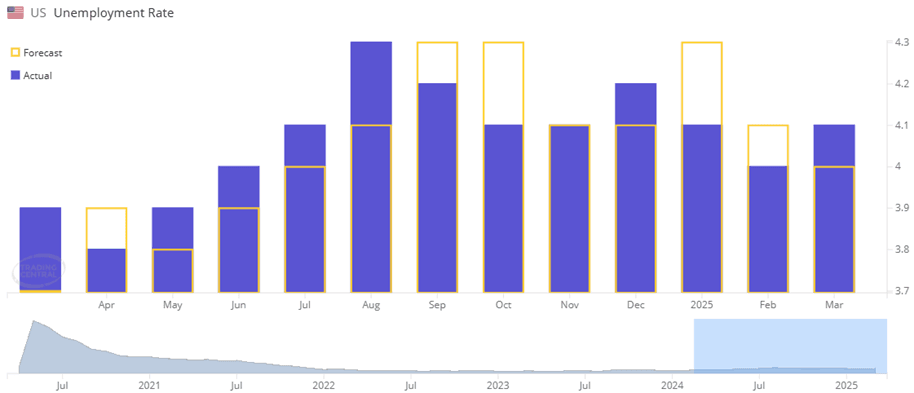

The U.S. unemployment rate was 4.1% in February, which is expected to remain unchanged at 4.1% in March. The data is set for release on April 4 at 13:30 GMT. The stability in the unemployment rate indicates a balanced labour market, where job gains and labour force participation remain relatively steady. While higher interest rates may slow hiring activity, strong consumer spending and business resilience continue to support employment levels. Additionally, the Federal Reserve's cautious monetary policy stance suggests that labour market conditions are neither overheating nor weakening significantly, contributing to the expected consistency in the unemployment rate.

(U.S. Unemployment Rate Chart, Source: Trading Central)

The U.S. nonfarm payrolls for February came in at 151K, while the figure for March is expected to decline to 80K. The data is set for release on April 4 at 13:30 GMT. The projected slowdown in job growth may be attributed to several factors, including the impact of high interest rates on business hiring, a cooling labour market, and seasonal adjustments following stronger employment gains in previous months. Additionally, companies may exercise caution amid economic uncertainty, leading to slower workforce expansion.

(U.S. Non-Farm Payrolls Chart, Source: Trading Central)

Canada's employment change for February was 1.1K, which is expected to increase to 30K in March. The data is set for release on April 4 at 13:30 GMT. The projected rebound in employment may be driven by seasonal hiring, increased labour demand in key sectors such as services and construction and improving business confidence. February's weak job growth was likely a temporary slowdown, and March's expected surge suggests a stronger labour market recovery.

(Canada Employment Change Chart, Source: Trading Central)

Top US company earnings: -

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.