CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Oct 17 2025 08:53

6 min

Investing in dividend stocks can be a rewarding strategy for generating passive income and building wealth over time.

This article delves into what dividend stocks are, how to invest in them, and provides a list of the top 20 high-dividend stocks for 2025.

1. What is a Stock Dividend?

A stock dividend is a payment made by a corporation to its shareholders, typically in the form of cash or additional shares. Unlike regular stock price appreciation, dividends provide a tangible return on investment, making them particularly appealing to income-focused investors.

Key Features of Stock Dividends

Regular Income: Dividends are usually paid quarterly, providing consistent income to shareholders.

Reinvestment Opportunities: Investors can choose to reinvest dividends to purchase more shares, potentially compounding their returns over time.

Indicator of Financial Health: A company that consistently pays dividends is often seen as financially stable and committed to returning value to its shareholders.

2. How to Invest in Dividend Stocks

Investing in dividend stocks involves several steps:

Research and Selection

Before investing, conduct thorough research on potential dividend-paying companies. Key factors to consider include:

Dividend Yield: The annual dividend payment divided by the stock price. A higher yield can indicate a better return, but it’s essential to evaluate the sustainability of that yield.

Payout Ratio: This ratio indicates the percentage of earnings paid out as dividends. A lower payout ratio suggests that a company has room to continue paying dividends even in tough economic times.

Company Fundamentals: Look at the overall financial health, growth potential, and industry position of the company.

Diversification

To mitigate risks, diversify your investments across various sectors and industries. This approach can help cushion your portfolio against market volatility.

Monitor Your Investments

Keep track of your dividend stocks and the performance of the companies. Regularly review financial reports and market conditions to make informed decisions about holding or selling your investments.

Consider Dividend Reinvestment Plans (DRIPs)

Many companies offer DRIPs, allowing investors to automatically reinvest their dividends into additional shares. This strategy can enhance the compounding effect of your investments over time.

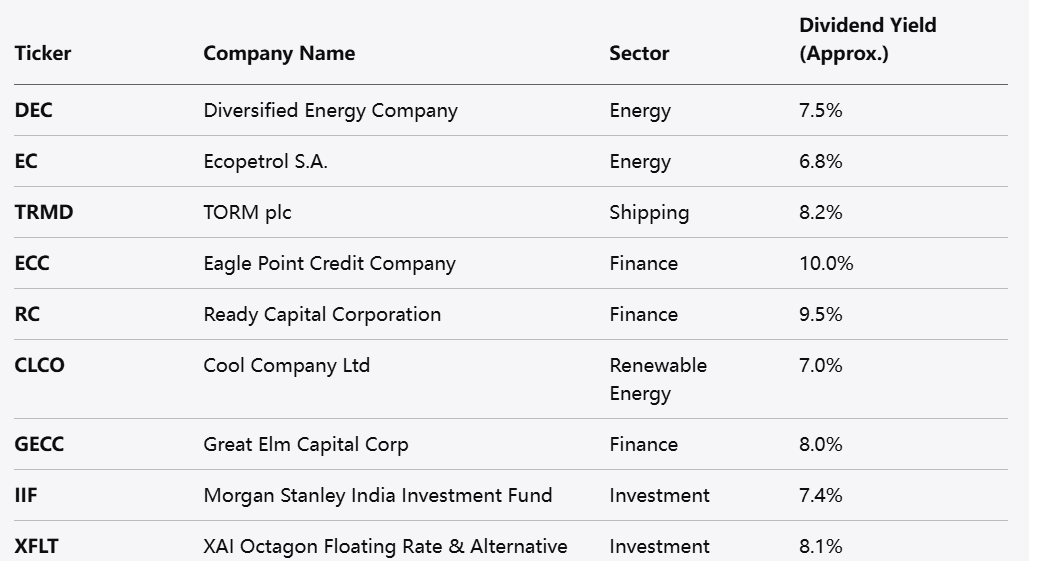

3. Top 20 High-Dividend Stocks List For 2025

The following list includes 20 high-dividend stocks for 2025, providing a mix of industries and sectors to consider for your investment portfolio.

Brief Overview of Each Stock

Diversified Energy Company (DEC): Focuses on natural gas and coal, providing stable dividends due to the essential nature of its services.

Ecopetrol S.A. (EC): Colombia's largest oil company, benefiting from global energy demand.

TORM plc (TRMD): A global shipping company, offering high dividends as a result of strong international trade.

Eagle Point Credit Company (ECC): Engages in credit investments, known for its high dividend yield.

Ready Capital Corporation (RC): Focuses on real estate finance, delivering consistent returns to shareholders.

Cool Company Ltd (CLCO): A renewable energy firm, aligning with sustainable investment trends.

Great Elm Capital Corp (GECC): Invests in various sectors, providing solid returns.

Morgan Stanley India Investment Fund (IIF): Focuses on Indian equities, capitalizing on growth in emerging markets.

XAI Octagon Floating Rate & Alternative Income Trust (XFLT): Offers a diversified income strategy, appealing in fluctuating interest rate environments.

Arbor Realty Trust (ABR): Focuses on real estate investments, providing robust dividends.

Franklin BSP Realty Trust Inc (FBRT): Invests in commercial real estate, delivering solid returns to investors.

Angel Oak Mortgage REIT Inc (AOMR): Specializes in mortgage loans, known for high yields.

International Seaways Inc (INSW): Operates a fleet of oil tankers, benefiting from global oil transport.

Civitas Resources Inc (CIVI): Engages in oil and gas exploration, providing attractive dividends.

CVR Energy Inc (CVI): Involved in refining and marketing, with strong cash flow supporting dividends.

Eagle Bancorp Inc (EGBN): A regional bank with a focus on community lending, delivering consistent payouts.

Evolution Petroleum Corporation (EPM): Engages in oil and gas production, offering high dividend yields.

Altria Group Inc (MO): A leading tobacco company, historically known for its strong dividend payments.

Alexander's Inc. (ALX): Invests in real estate, providing reliable returns to shareholders.

Washington Trust Bancorp, Inc. (WASH): A community bank with a strong dividend history.

Looking to trade stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Conclusion

Dividend stocks can be an excellent addition to any investment portfolio, offering the potential for regular income and long-term growth. The top 20 high-dividend stocks for 2025 provide a diverse array of opportunities across various sectors.

When considering investments in dividend stocks, it is essential to conduct thorough research and consider factors such as dividend yield, payout ratio, and overall company health. By carefully selecting dividend-paying stocks, investors can create a reliable source of income while also benefiting from capital appreciation over time. Always consult with a financial advisor to tailor your investment strategy to your specific financial goals and risk tolerance.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.