CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Oct 17 2025 08:37

7 min

Top 10 Trusted Forex Brokers of 2026: The foreign exchange (Forex) market is one of the largest financial markets in the world, where currencies are traded 24 hours a day.

For new traders, choosing a reliable Forex broker is crucial for success. In this article, we will explore the top ten trusted Forex brokers of 2026, highlighting their key features and what makes them stand out in the competitive landscape.

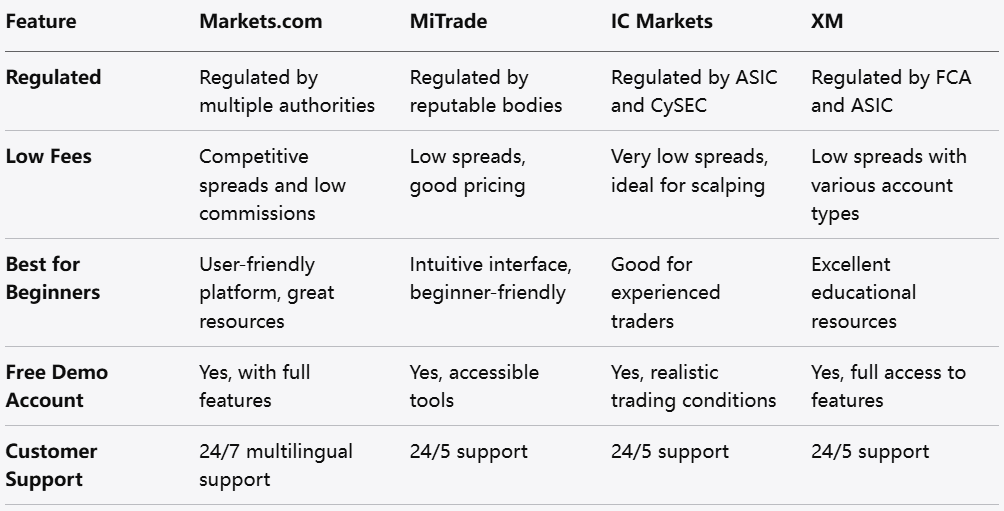

1. Markets.com

Overview

Markets.com is a well-established broker known for its user-friendly platform and extensive range of trading instruments. It offers a variety of accounts tailored to meet the needs of both beginners and experienced traders.

Key Features

User-Friendly Interface: The platform is designed for ease of use, making it accessible for new traders.

Wide Range of Instruments: In addition to Forex, Markets.com provides access to CFDs on stocks, commodities, and indices.

Educational Resources: The broker offers comprehensive educational materials, including webinars and articles.

2. MiTrade

Overview

MiTrade is gaining popularity for its competitive spreads and excellent customer support. It is particularly favored by beginners due to its intuitive trading platform.

Key Features

Competitive Spreads: MiTrade offers low spreads, making it an attractive option for cost-conscious traders.

Demo Account: New users can practice trading with a demo account before committing real funds.

24/7 Customer Support: The broker provides robust customer support to assist traders at any time.

3. IC Markets

Overview

IC Markets is renowned for its low latency and high-speed execution, making it a favorite among algorithmic traders and scalpers.

Key Features

ECN Trading: Offers direct access to the interbank market, providing tight spreads and low commissions.

Advanced Trading Tools: IC Markets supports various trading platforms, including MetaTrader 4 and MetaTrader 5.

Global Regulation: The broker is regulated by multiple authorities, ensuring a high level of trust and security.

4. XM

Overview

XM is a globally recognized broker that offers a diverse range of trading tools and educational resources. Its commitment to transparency makes it a trusted choice for traders.

Key Features

No Requotes Policy: XM guarantees that orders are executed at the requested price.

Free Educational Materials: The broker provides webinars, tutorials, and market analysis to help traders improve their skills.

Multiple Account Types: XM offers various account types to cater to different trading styles and preferences.

5. FXTM

Overview

FXTM, or ForexTime, is a well-regarded broker known for its flexible trading conditions and a wide range of account types suitable for various trader profiles.

Key Features

Low Minimum Deposit: FXTM allows new traders to start with a low initial investment.

Educational Programs: The broker offers extensive training programs to help traders understand the Forex market.

Multiple Trading Platforms: FXTM supports both desktop and mobile trading, providing flexibility for traders.

6. Pepperstone

Overview

Pepperstone is an Australian broker that has gained recognition for its low-cost trading environment and superior customer service, appealing to both retail and institutional traders.

Key Features

Low Spreads: Pepperstone is known for some of the lowest spreads in the industry.

Trading Platforms: Offers access to popular platforms like MetaTrader 4, MetaTrader 5, and cTrader.

Regulatory Compliance: The broker is regulated by ASIC and FCA, ensuring a high standard of security.

7. FXPro

Overview

FXPro is a well-established broker that offers a wide variety of trading instruments, including Forex, stocks, and commodities. Its reputation for reliability makes it a popular choice.

Key Features

Multiple Account Types: FXPro provides various account types tailored to different trading styles.

Advanced Trading Tools: The broker offers a range of analytical tools and resources for traders.

Regulated: FXPro is regulated by several reputable authorities, enhancing its credibility.

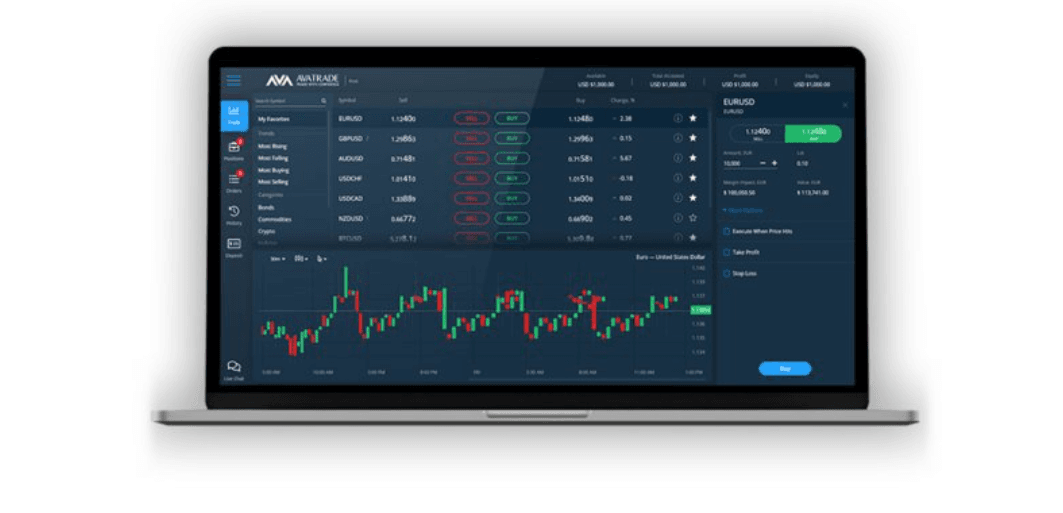

8. AvaTrade

Overview

AvaTrade is known for its comprehensive educational resources and user-friendly trading platform. It offers a range of trading options, including Forex and cryptocurrencies.

Key Features

Educational Resources: AvaTrade provides extensive training materials, making it suitable for beginners.

Multiple Trading Platforms: Offers various platforms, including AvaTradeGo and MetaTrader 4.

Regulatory Oversight: AvaTrade is regulated in multiple jurisdictions, ensuring trader protection.

9. IG

Overview

IG is a market leader in the Forex industry, known for its extensive range of trading instruments and advanced trading technology.

Key Features

Wide Range of Markets: IG offers access to thousands of markets, including Forex, stocks, and commodities.

Advanced Trading Tools: The broker provides sophisticated trading tools and analysis for informed decision-making.

Excellent Customer Support: IG is known for its responsive customer service and comprehensive educational resources.

10. AxiTrader

Overview

AxiTrader is an Australian Forex broker that has built a reputation for transparency and competitive pricing. It caters to both novice and experienced traders.

Key Features

Transparent Pricing: AxiTrader is known for its clear and fair pricing structures.

Educational Support: Offers a range of educational resources, including webinars and tutorials.

Regulated Environment: The broker is regulated by ASIC, ensuring a secure trading environment.

Conclusion

Selecting the right Forex broker is essential for success in the currency trading market. The top ten brokers listed here—Markets.com, MiTrade, IC Markets, XM, FXTM, Pepperstone, FXPro, AvaTrade, IG, and AxiTrader—each offer unique features that cater to different trading needs.

Key Considerations

When choosing a broker, consider the following factors:

Regulation: Ensure the broker is regulated by a reputable authority.

Trading Costs: Look for competitive spreads and low commissions.

Platform Usability: Choose a trading platform that matches your trading style and preferences.

Educational Resources: Access to training materials can be beneficial, especially for beginners.

By taking the time to research and evaluate these factors, traders can make informed decisions that align with their financial goals. Whether you are a novice or an experienced trader, the right broker can significantly impact your trading success.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.