CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Oct 17 2025 10:10

6 min

The Japanese Yen (JPY) has long been a pivotal currency in global foreign exchange markets. Understanding its dynamics can help traders make informed decisions, especially regarding the USD/JPY currency pair. This analysis provides insights into the factors influencing the Yen, its forecast for 2025 and 2026, and whether it is a good pair to trade.

Understanding the Japanese Yen

The Japanese Yen is the official currency of Japan and serves as a major reserve currency. Its significance in the forex market stems from Japan's status as one of the world's largest economies. The Yen is often viewed as a safe-haven currency, meaning that it tends to strengthen during periods of economic uncertainty or market volatility.

Key Characteristics of the Yen

Safe-Haven Currency: Investors flock to the Yen during geopolitical tensions or financial crises, leading to appreciation against other currencies.

Interest Rates: The Bank of Japan (BOJ) plays a crucial role in influencing the Yen's value through its monetary policy, particularly its interest rates.

Economic Indicators: Economic data such as GDP growth, inflation, and trade balance significantly impact the Yen's performance.

Factors Influencing the Yen

Several factors can influence the strength of the Japanese Yen, making it essential for traders to stay informed:

1. Monetary Policy

The Bank of Japan's monetary policy is a primary driver of the Yen's value. The bank has maintained a loose monetary policy for years, including negative interest rates and quantitative easing, to stimulate economic growth. Any shift toward tightening could lead to a stronger Yen, while continued easing may weaken it.

2. Economic Performance

Japan's economic health is crucial for the Yen's valuation. Key indicators include:

GDP Growth: Sustained economic growth can bolster the Yen as it attracts foreign investment.

Inflation Rates: Rising inflation may prompt the BOJ to adjust interest rates, impacting the Yen's strength.

Trade Balance: Japan is a major exporter, and a positive trade balance generally supports the Yen.

3. Global Economic Conditions

Global economic stability significantly impacts the Yen. During times of economic uncertainty, investors often flock to safe-haven assets, leading to Yen appreciation. Conversely, a robust global economy may weaken the Yen as investors seek higher returns in riskier assets.

4. U.S. Dollar Strength

The USD/JPY pair's performance is directly influenced by the strength of the U.S. Dollar. Factors affecting the Dollar, such as U.S. interest rates and economic data, will also impact the Yen. A strong Dollar often leads to a weaker Yen and vice versa.

Current Economic Landscape

As of late 2023, the global economy is facing various challenges, including inflationary pressures, supply chain disruptions, and geopolitical tensions. The Bank of Japan's stance on monetary policy remains crucial as it navigates these complexities.

Recent Developments

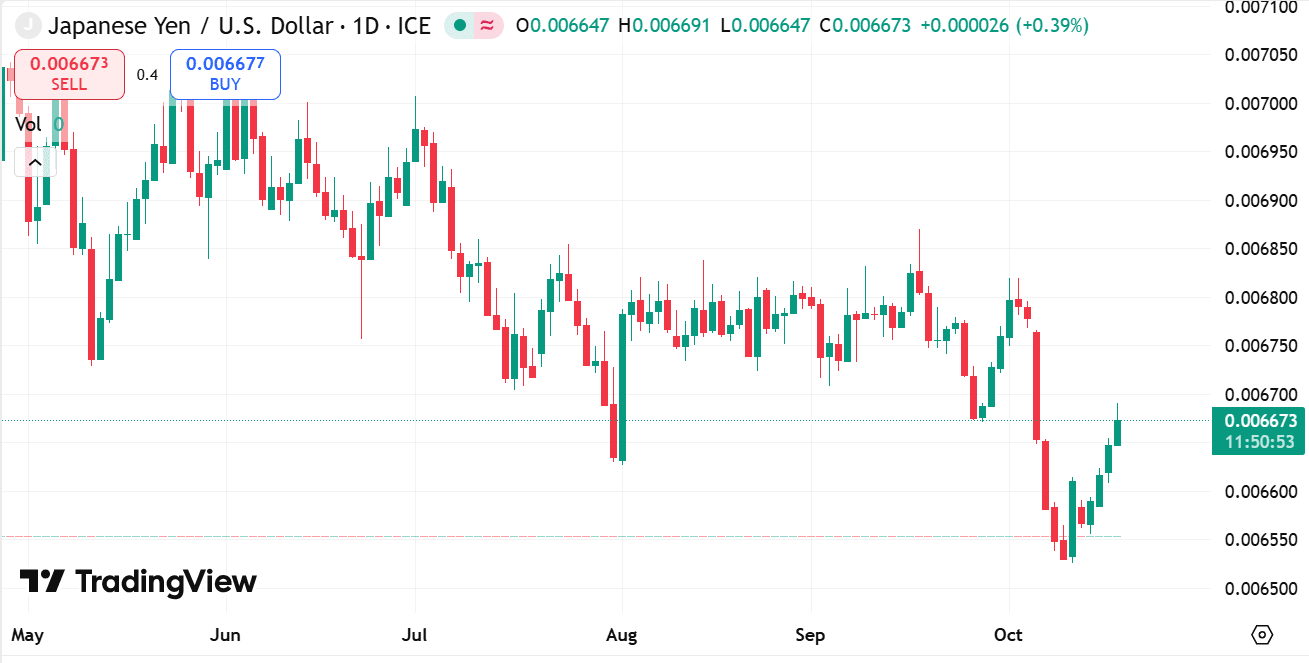

source: tradingview

Interest Rates: The BOJ has maintained its accommodative stance, but there are signs that it may consider tightening in response to rising inflation.

Inflation: Japan has experienced higher inflation rates, prompting discussions about potential policy changes.

Global Uncertainty: Ongoing geopolitical tensions and economic challenges have led to fluctuations in the Yen's value.

Japanes Yen Forecast for 2025/2026

Economic Projections

Analysts predict that the Japanese economy will continue to recover gradually. Key factors influencing the forecast include:

Monetary Policy Adjustments: If the BOJ shifts towards a tighter monetary policy, it could strengthen the Yen.

Global Economic Conditions: A stable global economy may lead to a weaker Yen as investors seek higher returns elsewhere.

Domestic Economic Growth: Continued growth in Japan's GDP could provide support for the Yen.

Japanese Yen Technical Analysis

From a technical perspective, the USD/JPY pair has shown significant volatility. Traders should monitor key support and resistance levels to gauge potential price movements.

Support Levels: Key support levels to watch include recent lows that may indicate buying opportunities.

Resistance Levels: Resistance levels can signify potential selling points or areas where the price may struggle to rise.

Is USD/JPY a Good Pair to Trade?

Advantages of Trading USD/JPY

Liquidity: The USD/JPY pair is one of the most liquid currency pairs, making it easy to enter and exit trades.

Volatility: The pair often experiences significant price movements, providing opportunities for traders to capitalize on short-term fluctuations.

Economic Correlation: The close relationship between the U.S. and Japanese economies provides a solid basis for analysis and forecasting.

Considerations for Trading

Market Sentiment: Traders should remain aware of global economic conditions and market sentiment, as these can impact the Yen's value.

Technical Analysis: Utilizing technical indicators and chart patterns can help traders identify potential entry and exit points.

Risk Management: Implementing effective risk management strategies is crucial when trading the USD/JPY pair, especially given its volatility.

Looking to trade forex CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Conclusion

The Japanese Yen remains a significant currency in the forex market, influenced by various economic factors and global conditions. The USD/JPY pair presents several opportunities for traders, particularly due to its liquidity and volatility.

As we look toward 2025 and 2026, the Yen's performance will largely depend on the Bank of Japan's monetary policy decisions, Japan's economic growth, and global economic stability. Traders should stay informed and employ sound analysis strategies to navigate the complexities of this currency pair effectively.

In summary, while trading USD/JPY can be lucrative, it requires careful consideration of market dynamics, economic indicators, and risk management practices. With the right approach, traders can capitalize on the opportunities presented by this pivotal currency pair.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.