Sunday Aug 17 2025 04:48

5 min

The U.S. retail sales rose 0.6% m/m in June, and market consensus projects a 0.6% gain in July. Meanwhile, core retail sales (excluding autos) increased 0.5% in June, with expectations pointing to a slower 0.3% rise in July.

The steady headline forecast for July likely reflects optimism that stronger auto sales and gasoline prices will continue to support overall retail figures, even if consumer discretionary spending growth slows. In contrast, the softer outlook for core retail sales suggests that underlying demand, excluding volatile components, may be moderating, as higher borrowing costs and elevated prices gradually weigh on household budgets. This moderation aligns with signs from early July data indicating slower momentum in categories like clothing, electronics, and home goods.

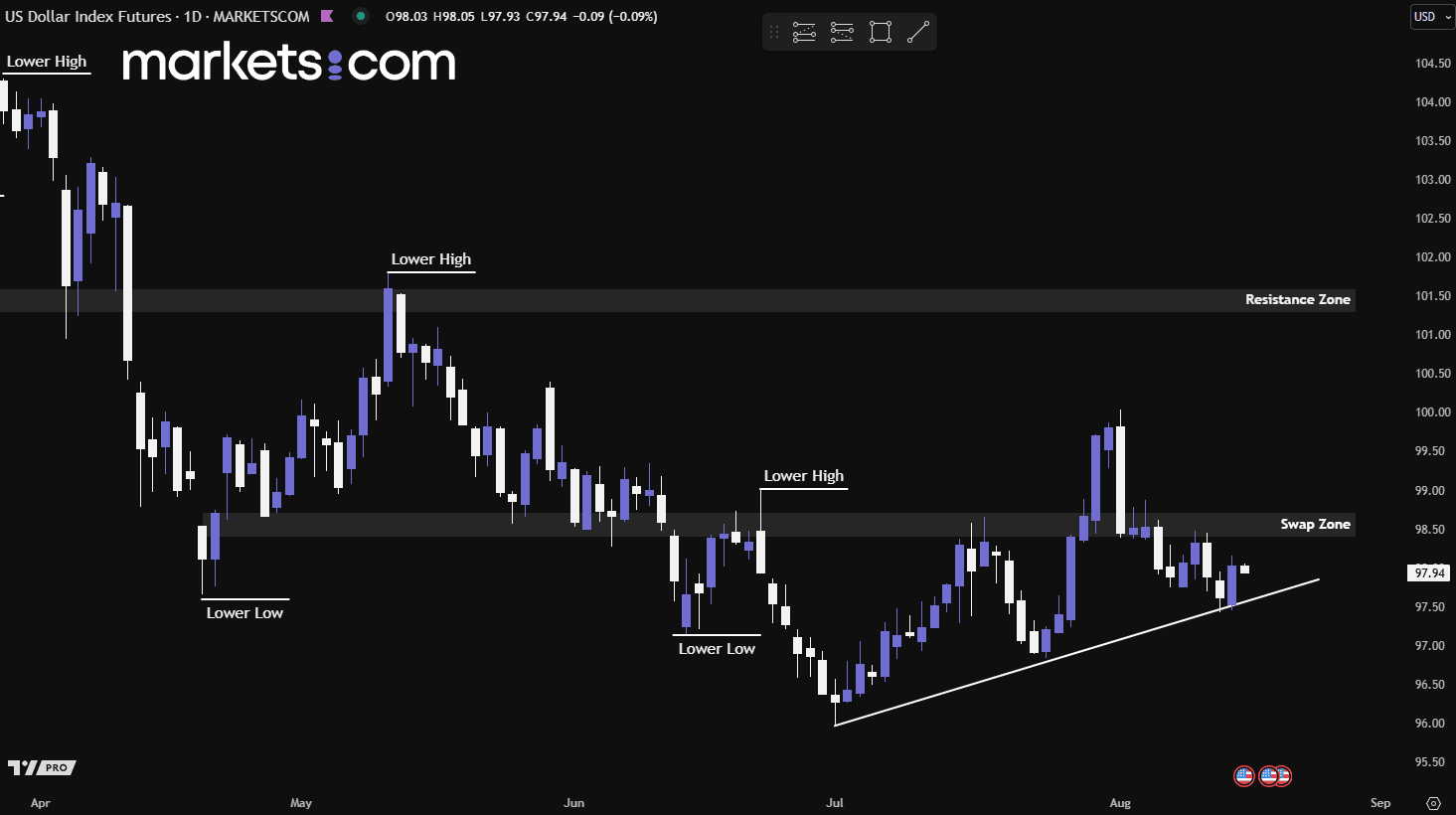

(U.S Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. dollar has been in a bearish trend since mid-January 2025, as indicated by the lower highs and lower lows. Recently, it rebounded from the ascending trend line, but this does not necessarily mean the bulls have regained control. For the bulls to reclaim dominance, the index would need to break above the swap zone of 98.40 – 98.70 to continue surging upwards. Therefore, the battle between bears and bulls within this trend line and swap zone is crucial, as it could potentially determine the next directional move.

U.S. Treasury Secretary Scott Bessent clarified on Thursday that his department is still exploring budget-neutral methods to acquire Bitcoin for the Strategic Bitcoin Reserve, reversing market perceptions from earlier remarks that had suggested the plan was shelved and had triggered a sell-off in BTC. He emphasised that the Treasury remains committed to executing the President’s vision of making the United States the “Bitcoin superpower of the world.”

Bessent also reaffirmed that Bitcoin seized and forfeited to the federal government will serve as the foundation of the reserve. His clarification comes amid concerns over the slow pace of implementing the strategy, with critics warning that delays could allow other nation-states to front-run U.S. accumulation or even raise doubts about whether the Treasury will follow through on the plan.

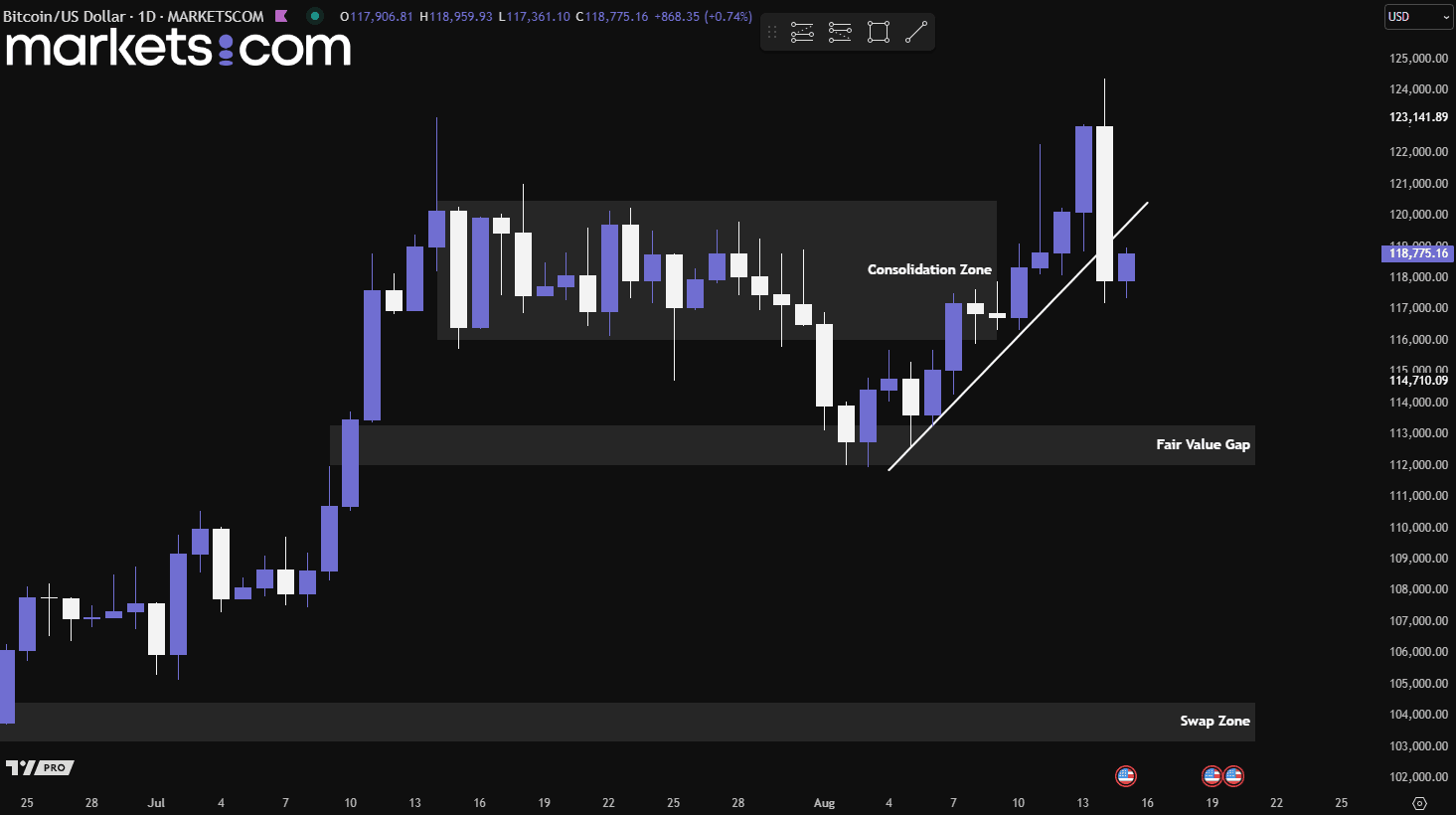

(Bitcoin Daily Price Chart, Source: Trading View)

From a technical analysis perspective, Bitcoin recently broke below the consolidation zone of 116,000 – 120,500 but found strong support at the bullish fair value gap of 112,000 – 113,300. It then gained bullish momentum and surged upwards, eventually reaching the previous liquidity level of 123,141. However, bearish forces pushed it lower, breaking below the upward trend line, indicating diminished bullish momentum. Therefore, the price could potentially move higher to retest the trend line, but a failure to close above it could potentially drive the price lower.

Two Republican senators are urging a congressional investigation into Meta Platforms after a Reuters report revealed an internal policy allowing chatbots to “engage a child in romantic or sensual conversations.” Meta confirmed the document’s authenticity but said it deleted the sections only after Reuters’ questions. Senator Josh Hawley called the timing “grounds for an immediate congressional investigation.”

Senator Marsha Blackburn backed the probe, saying the case underscores the need for the Kids Online Safety Act, which passed the Senate but stalled in the House. She accused Meta of “failing miserably” to protect children and ignoring the harmful design of its platforms.

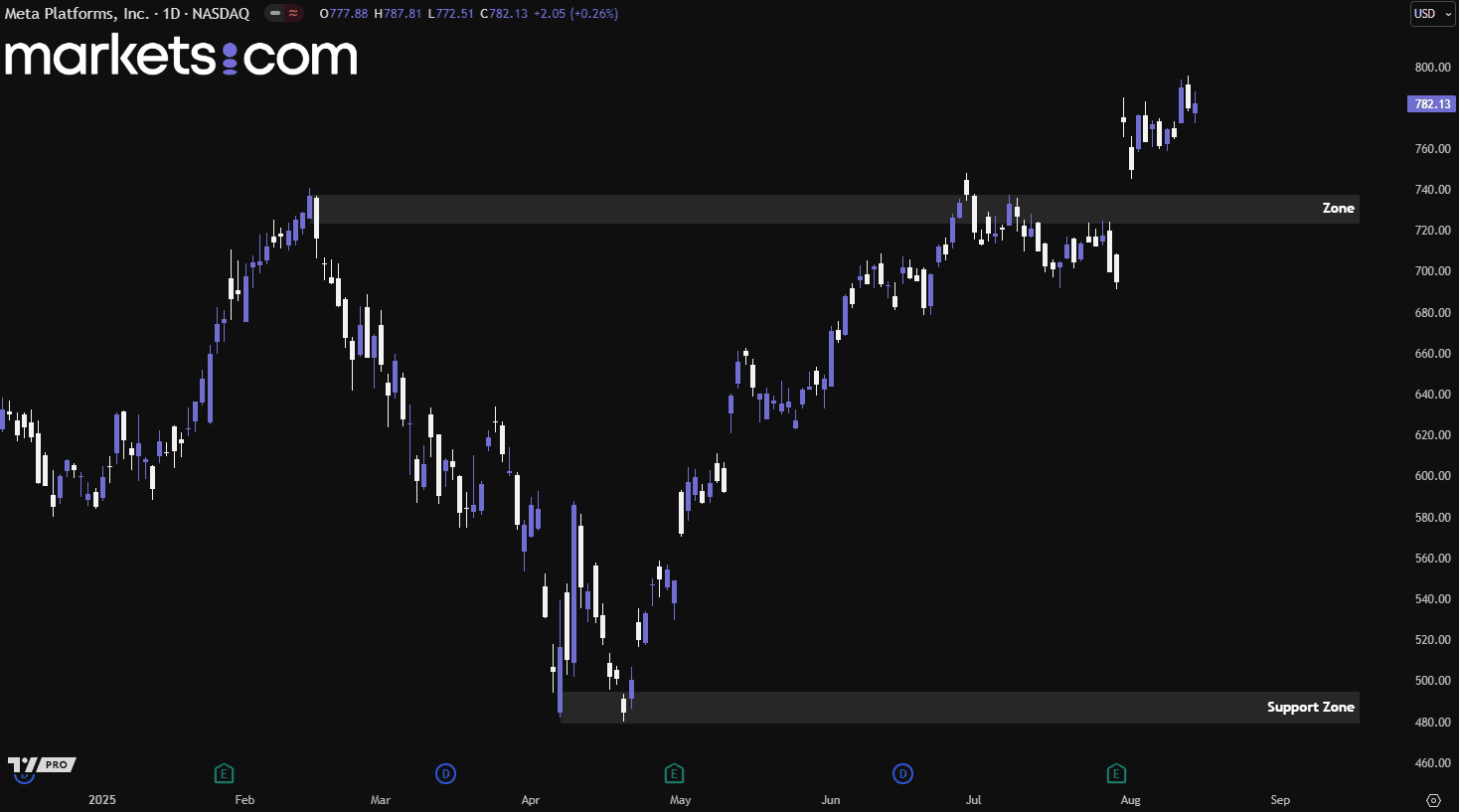

(Meta Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, Meta’s share price has been rebounding from the support zone of 480 – 495 since the beginning of April 2025, as indicated by the higher highs and higher lows. Recently, bullish momentum drove the price above the 724 – 738 zone, leaving a significant gap. The price is now consolidating within a narrow range, suggesting temporarily diminished bullish momentum. Therefore, it may potentially pull back to fill the gap before determining its next directional move.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.