Thứ tư Aug 6 2025 07:38

5 phút

The Federal Reserve held interest rates steady in a split decision, offering no clear signal on when rate cuts might begin. Despite political pressure, including dissent from two Trump-appointed governors who view current policy as overly tight, the Fed chose a cautious stance. Chair Jerome Powell emphasised flexibility, stating, “We have made no decisions about September,” and highlighted the importance of gathering more data before the next policy meeting.

Moreover, investors have scaled back expectations for a September cut, with futures pricing in a 46% chance, down sharply from 65% the previous day. Markets are no longer fully pricing in two 25-basis-point cuts by year-end, reflecting the growing belief that rates will stay restrictive for longer.

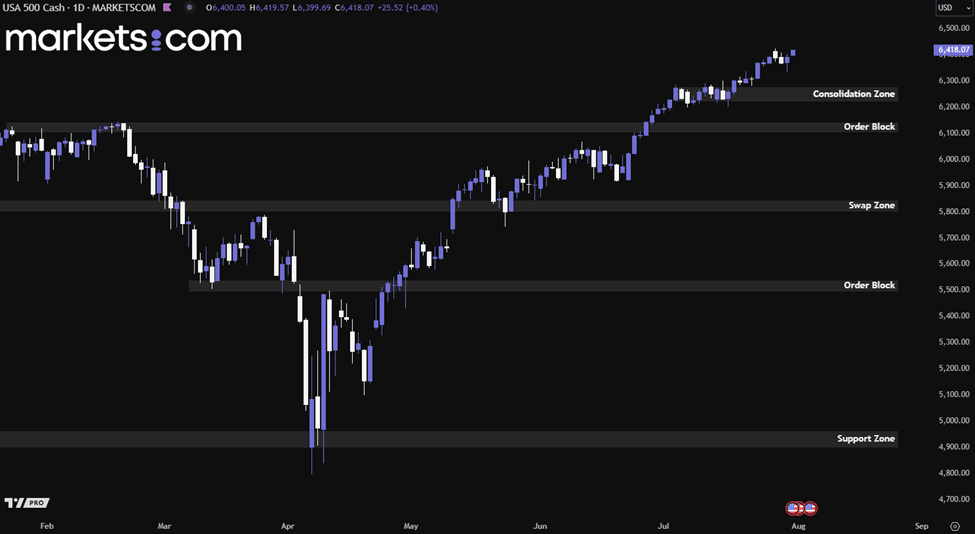

(S&P 500 Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the S&P 500 index has been in a bullish trend since April 2025, as evidenced by a series of higher highs and higher lows. Recently, it broke above the consolidation zone of 6,220 – 6,280 with strong bullish momentum, indicating that bullish forces remain intact. This valid bullish structure may potentially continue to drive the index higher.

A cryptocurrency working group established by President Donald Trump on Wednesday laid out the administration’s position on key crypto legislation. It urged the U.S. Securities and Exchange Commission (SEC) to introduce regulations explicitly tailored to digital assets. The recommendations came ahead of a major report expected to shape future crypto policy.

In a fact sheet, the White House called on Congress to advance legislation that would create a formal regulatory framework for digital assets, while also encouraging the inclusion of specific provisions. These include allowing trading platforms to also serve as custodians and implementing a customised disclosure regime for crypto securities issuers. The administration also urged both the SEC and the Commodity Futures Trading Commission (CFTC) to use their current authorities to facilitate federal-level digital asset trading immediately.

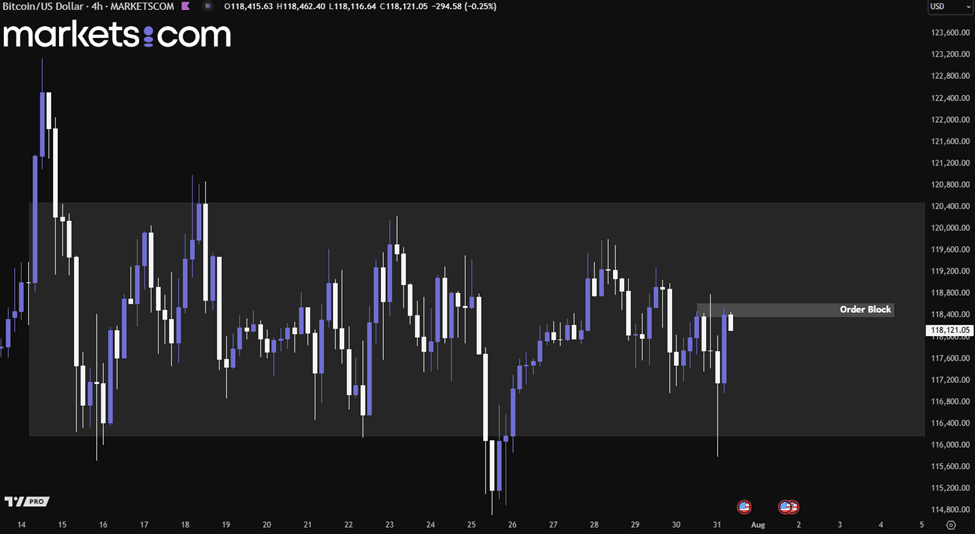

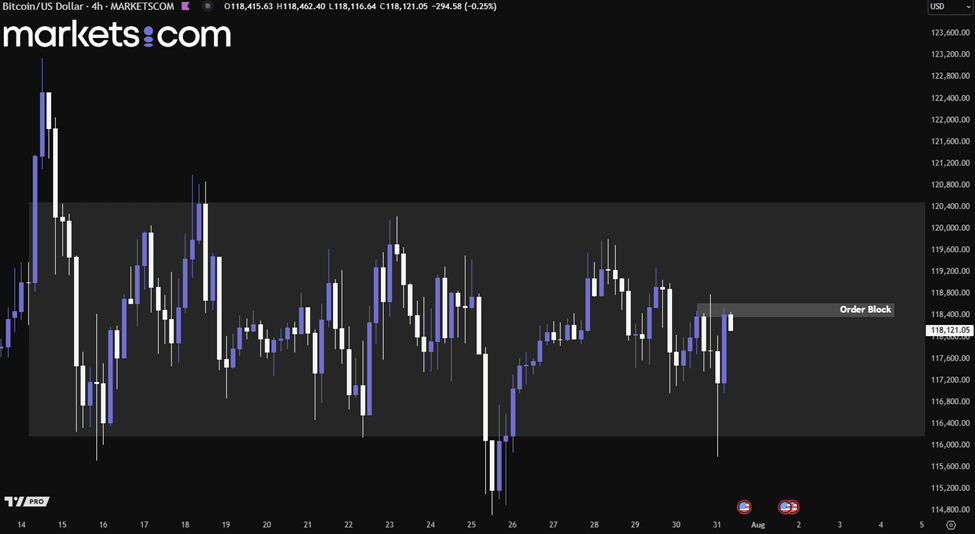

(Bitcoin 4H Price Chart, Source: Trading View)

From a technical analysis perspective, Bitcoin has been trading within a consolidation zone between 116,000 and 120,500 since mid-July 2025. Recently, the price dipped below the range but found support and closed back within the zone. It then continued to surge upward but faced temporary rejection at the order block between 118,000 and 118,600. If the price can break above this order block, it may potentially move higher toward the upper boundary of the consolidation zone.

Crude oil futures climbed above $70 per barrel on Thursday at the time of writing during the Asian trading session, marking a fourth consecutive gain and hitting a six-week high amid growing concerns over tighter global supply. The rally was driven by escalating geopolitical tensions as President Trump announced tariffs on Indian exports and penalties on its Russian oil imports. Simultaneously, the U.S. imposed its most sweeping sanctions on Iran in seven years, raising fears of knock-on effects on refined products like diesel.

Adding to the volatility, Trump gave Russia a 10-day deadline to resolve trade disputes or face 100% secondary tariffs, potentially pressuring U.S. allies to reduce Russian crude imports. However, downside pressure came from U.S. Energy Information Administration (EIA) data showing a surprise 7.7-million-barrel jump in crude inventories last week, the largest rise in six months, defying expectations of a draw. Investors now await this weekend’s OPEC+ meeting, where a significant output hike is anticipated.

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, crude oil futures recently retested the swap zone of 64.10 – 64.80, found support, and continued to move higher. The price also collected liquidity along the bearish trendline, as indicated by the dotted white line, providing additional confirmation for further upside. This valid bullish movement may potentially drive the price higher to retest the 73.00 level.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.