Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

You are about to enter a website operated by an entity not regulated within the EU. Products and services available on this website are not subject to EU laws and ESMA protections. Your rights, regulatory safeguards, and investor protections may differ from those applicable under EU regulation. If you wish to continue under the protection of EU regulatory requirements, please remain on the EU-regulated website.

Sunday Aug 24 2025 04:56

5 min

U.S. stock futures edged higher on Friday as investors awaited Federal Reserve Chair Jerome Powell’s speech at Jackson Hole for clues on the direction of interest rates. Markets remain cautious that Powell may dampen hopes for a near-term rate cut.

In extended trading, Intuit slipped over 5% despite posting solid quarterly results, while Zoom gained nearly 6% on stronger-than-expected second-quarter earnings. On Thursday, the Dow and Nasdaq both declined 0.34%, and the S&P 500 fell 0.4%. Walmart dragged market sentiment down, plunging 4.5% after missing earnings estimates for the first time since 2022, even as it raised its full-year outlook. Broader retail weakness added to concerns over consumer resilience amid higher tariffs and uneven spending patterns.

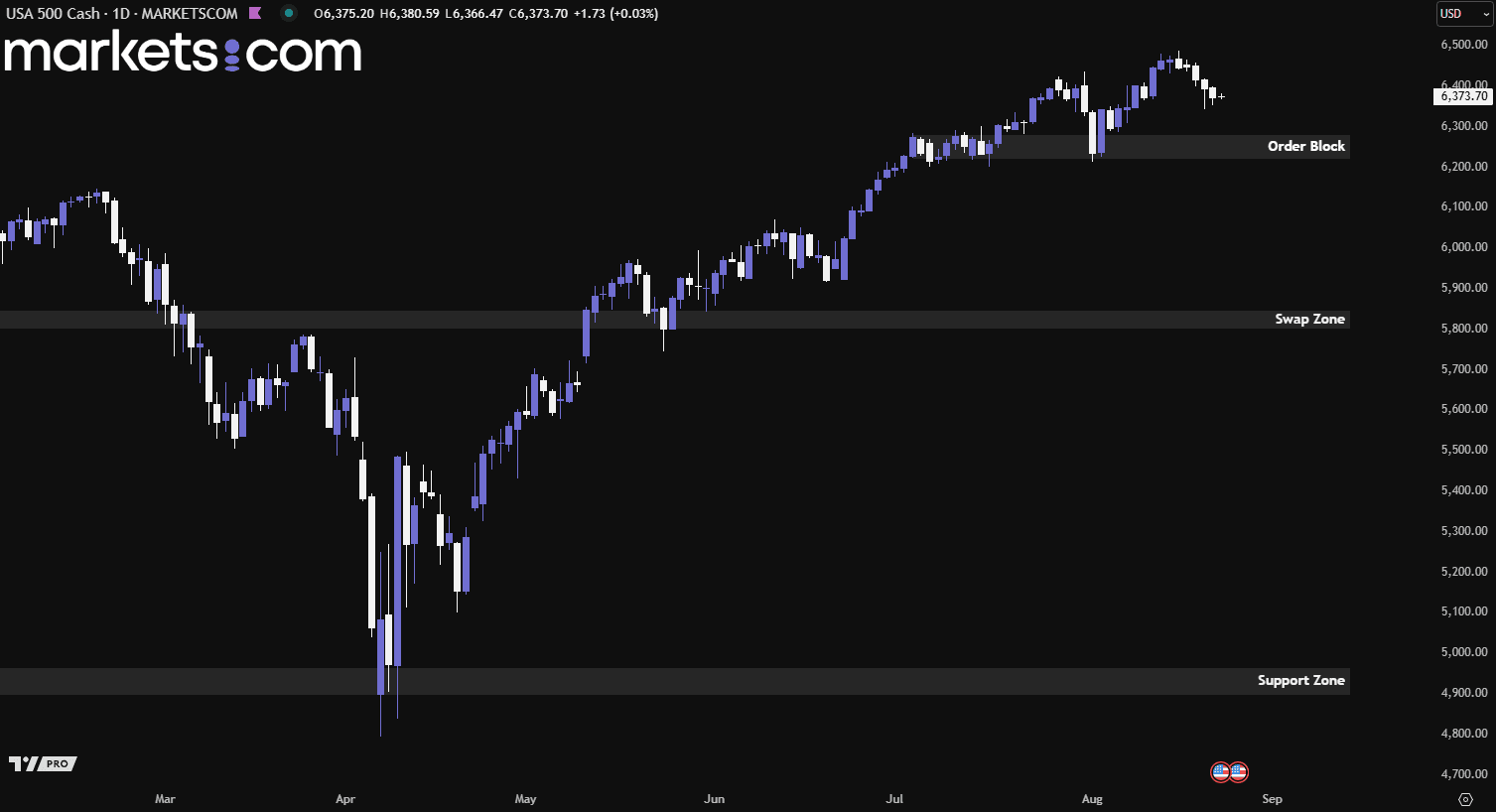

(U.S. 500 Cash Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. 500 cash index has been trending bullishly since early April 2025, as reflected by higher highs and higher lows. Recently, it experienced a pullback, indicated by a consecutive series of bearish candles, suggesting the index may potentially decline further to retest the order block at 6,220 – 6,280. If it breaks below this zone, the index could continue to move lower.

The Trump administration’s shifting tariff policies continue to unsettle global trade. On Tuesday, it announced an extension of tariff delays on China while introducing new aluminium tariffs on over 400 products, including wind turbines, mobile cranes, railcars, motorcycles, and construction equipment. Trade groups such as the National Foreign Trade Council (NFTC) warned that these measures are “delaying growth, disrupting operations, and raising legal concerns for companies.”

Amid this uncertainty, some administration-linked officials have increased their involvement in sectors impacted by these policies, including Bitcoin (BTC) and other industries tied to shifting trade dynamics. The unpredictable nature of President Trump’s tariffs is fueling both market anxiety and speculative investment.

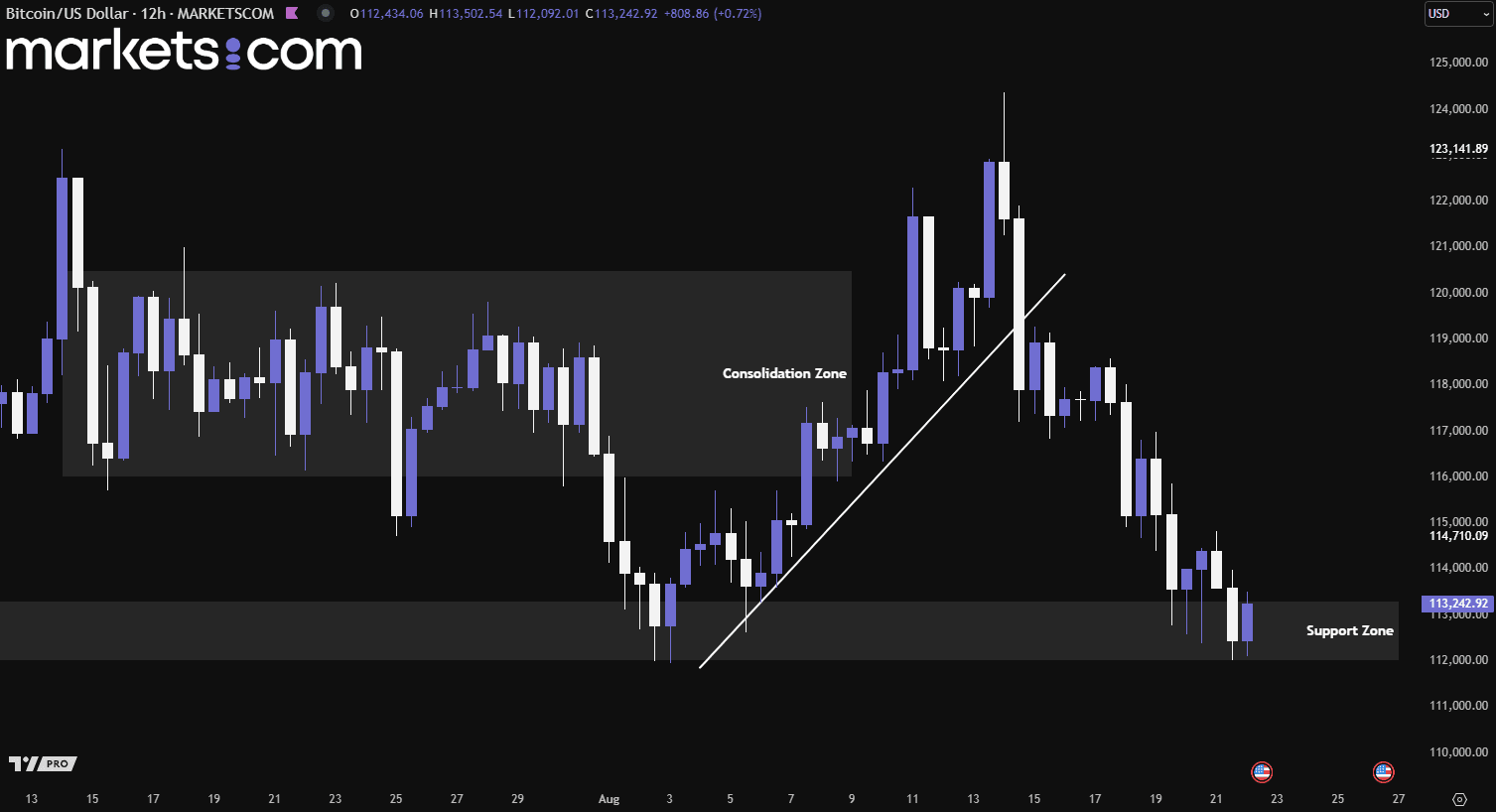

(Bitcoin Daily Price Chart, Source: Trading View)

From a technical analysis perspective, Bitcoin recently broke above the consolidation zone of 116,000 – 120,500 but was quickly rejected by bearish momentum, pushing the price lower and even breaking below the white bullish trendline. The price then continued to decline and is now retesting the support zone at 112,000 – 113,300.

The reaction within this zone is crucial as it may determine Bitcoin’s next move. If the price finds support here, it could resume its bullish momentum and move higher. Conversely, if bearish pressure breaks this zone, the price may potentially fall further.

WTI crude futures hovered above $63.5 per barrel on Friday during the Asian trading session at the time of writing, set for their first weekly gain in three weeks, supported by signs of robust U.S. demand and ongoing uncertainty surrounding Russia-Ukraine peace talks. U.S. inventories posted the largest nationwide draw since mid-June, driven by higher refinery runs and stronger exports, though continued builds at Cushing hinted at softer underlying demand.

Meanwhile, geopolitical tensions remained in focus as Washington urged direct Russia-Ukraine engagement while the Kremlin stayed noncommittal. The U.S. also increased pressure on India over its Russian crude imports, imposing a 25% tariff on Indian goods effective August 27. Traders now await Federal Reserve Chair Jerome Powell’s Jackson Hole remarks for clues on future monetary policy that could shape global oil demand.

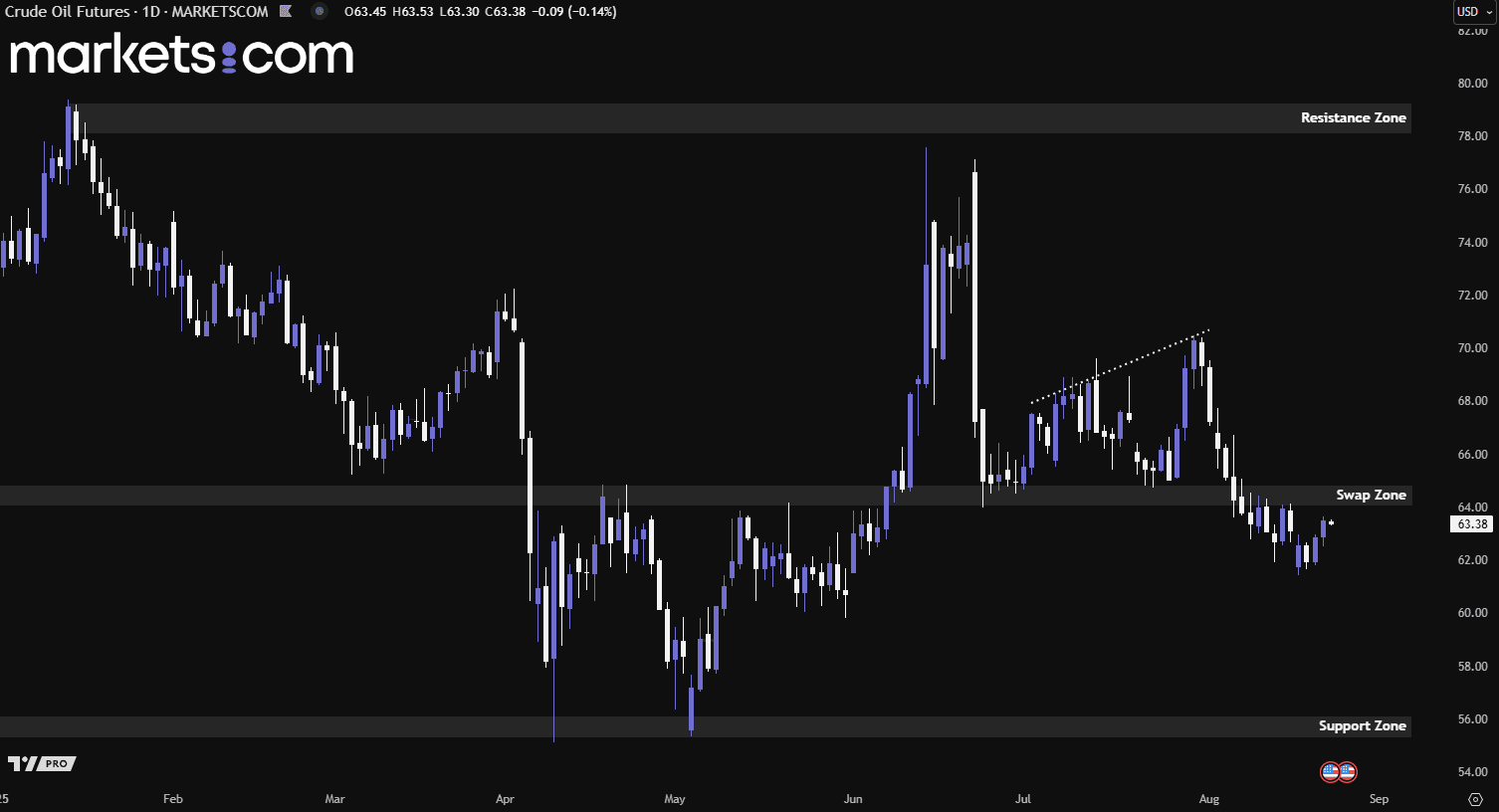

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, crude oil futures recently broke below the swap zone of 64.10 – 64.80, signalling a shift in momentum from bullish to bearish. The price attempted to retest this zone twice but was rejected by bearish pressure, pushing it lower. However, it has risen over the past two days and is now approaching the swap zone again. If it fails to break above this level in the near term, the prevailing bearish structure suggests the price may continue to decline.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.