You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

วันอังคาร พฤษภาคม 10 2022 11:29

5 นาที

Leading tech companies lose over $1 trillion in the last three trading days

Stocks have been bearish since Wednesday following the Federal Reserve’s decision to raise its benchmark interest rate by 50 basis points, with the tech sector struggling the most.

The popular #Terra luna UST #stablecoin which is pegged to maintain a $1 balance dipped by nearly 70% Wednesday morning down to the 30 pence value – an all-time low. #Coinbase announced a 44% dip in its overall trading volumes in Q1.https://t.co/XMNqAQvWTv pic.twitter.com/fDzsFtrR9w

— Markets.com (@Marketsdotcom) May 12, 2022

Apple (AAPL) the world’s most profitable company lost over 8% of its value since Wednesday, closing at $152.06 on Monday.

Other companies that were hit hard by the Fed’s decision were:

The S&P 500 stock index also suffered great losses in the past three trading days, falling below the $4,000 mark on Monday, declining by 7% since Wednesday, while NASDAQ 100 fell by nearly 10% during that same time period.

Commodities also swept in sell-off

Commodities were also swept up in the brutal sell-off on Wall Street as US stocks continued to slump for the third day in a row.

Oil has been suffering one of the biggest blows so far as lockdowns in China are holding on and tensions between Russia and the West continue to surge.

West Texas Intermediate futures were down over 0.3% in early Tuesday trading hours meanwhile Brent crude was down 0.2%.

Gold prices are performing well this morning. Spot gold was up 0.2%, spot silver gained 0.4%, palladium rose 0.5% while platinum dipped 0.1%.

US natural gas futures Henry Hub dipped 0.7% on Tuesday to $6.968/MMBtu, from Monday’s value, after surging by more than 18% last week and capping at $8.773/MMBtu on Thursday.

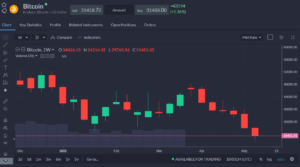

Bitcoin falls below $30,000, first time since July 2021

The top cryptocurrency by market capitalization, bitcoin (BTC), fell for the first time since July 2021 to levels below the $30,000 mark on Tuesday.

So far in May, the cryptocurrency lost 16% of its value, falling from the $37,000 levels at the start of the month to its current $31,000 levels.

Ethereum (ETH), the second largest cryptocurrency by market capitalization, also declined this month, losing 14.5%, down from the $2,700 levels to $2,380 levels.

Note, cryptocurrency CFD trading is restricted in the UK for all retail clients.

EU stocks rally Tuesday morning

European stocks looked bullish in the early trading hours on Tuesday as markets are looking to rebound from the recent sell-off.

London’s FTSE 100 saw 0.72% gains, meanwhile France’s FCHI was up over 1% with Germany’s DDAXI following close behind.

The pan-European STOXX 600 has also been experience big gains on Tuesday morning, rising by 0.74% from last night’s close.

More positive EU stocks news – Bayer stocks rally following great Q1 earnings report

The German pharmaceutics company Bayer (BAYN) released on Tuesday its first quarter 2022 earnings report announcing a “very good start to the year.”

The firm’s sales amounted up to €14.639 billion (around $15.45 billion) this quarter, up 14.3% since this time last year following strong earnings at the company’s seeds and pesticides business.

“We achieved outstanding sales and earnings growth, with particularly substantial gains for our agriculture business … Our forecast going forward this year remains confident despite the great uncertainties, including the stability of supply chains and energy supplies, and we confirm the currency-adjusted outlook for the full year published in March,” Bayer’s chairman of the board of management, Werner Baumann said in the report.

Following a successful Q1 report, the company’s stocks saw an over 0.30% increase on Tuesday’s market open.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.