Ahad Aug 24 2025 05:08

7 min.

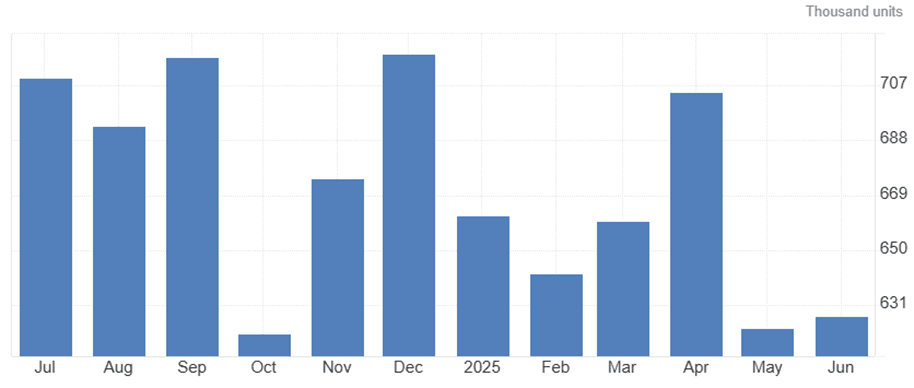

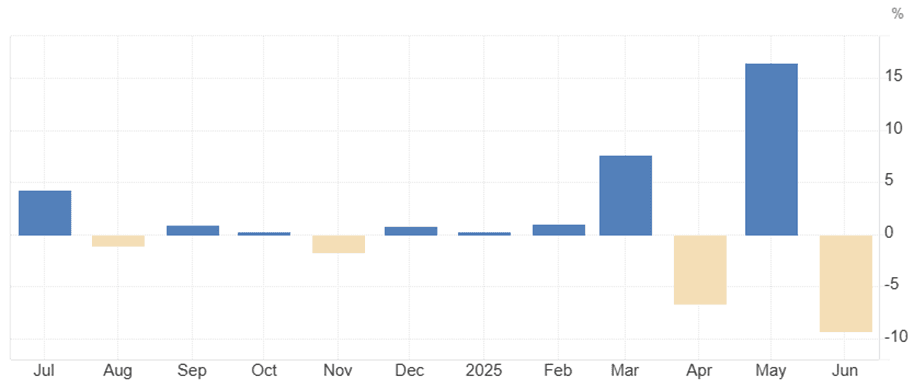

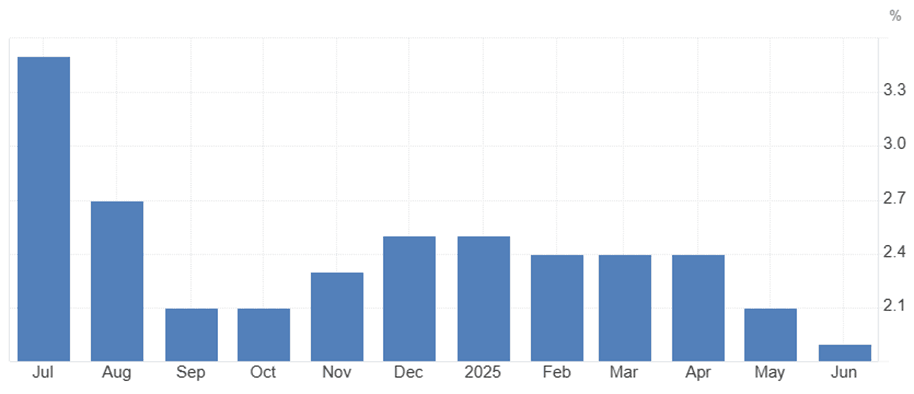

On Monday, 25 August 2025 [14:00 GMT], the U.S. will release New Home Sales for July, expected to ease to 0.62M after June’s 0.627M. The following day, Tuesday, 26 August [12:30 GMT], U.S. Durable Goods Orders for July are forecast to fall 2.5%, moderating from June’s sharp 9.3% drop. On Wednesday, 27 August [01:30 GMT], Australia’s Monthly CPI Indicator for July is due, with expectations of a slight rise to 2% from 1.9% in June.

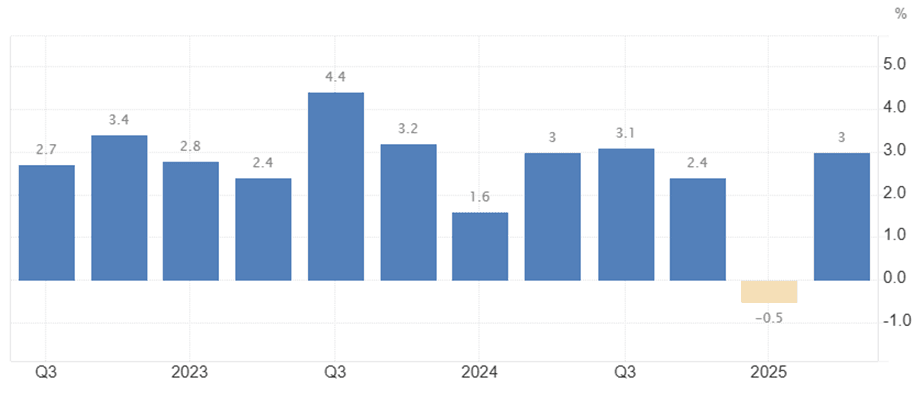

On Thursday, 28 August [12:30 GMT], the U.S. will publish Q2 GDP growth, forecast to rebound 3.0% after a 0.5% contraction in Q1, alongside Pending Home Sales for July, expected to dip 0.2% versus June’s 0.8% fall. Finally, on Friday, 29 August [12:30 GMT], Canada’s June GDP is projected to edge up 0.1% after May’s 0.1% contraction, while the U.S. Core PCE Price Index for July is expected to slow to 0.2% from June’s 0.3%.

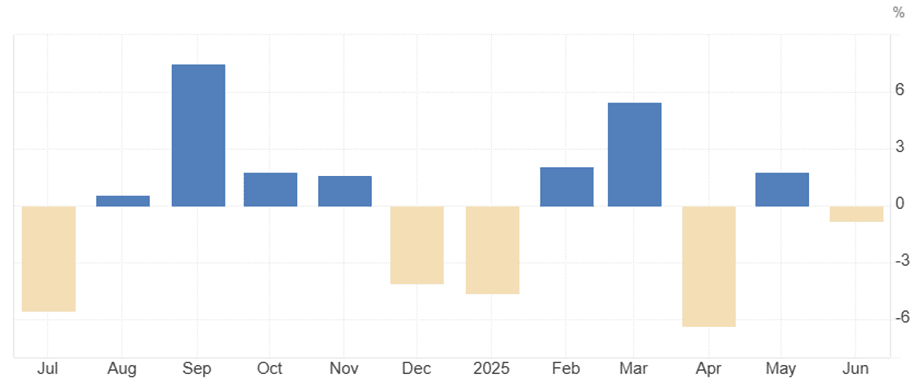

U.S. new home sales came in at 0.627 million in June, with July sales expected to ease slightly to 0.62 million. On a monthly basis, June recorded a modest 0.6% increase, but July is projected to fall by 1.1%. The weaker outlook reflects higher mortgage rates and affordability pressures that continue to weigh on housing demand, alongside lingering supply constraints and elevated construction costs, which together temper buyer activity despite a resilient labour market. This data is set to be released on 25 August at 1400 GMT.

(U.S. New Home Sales Chart, Source: Trading Economics)

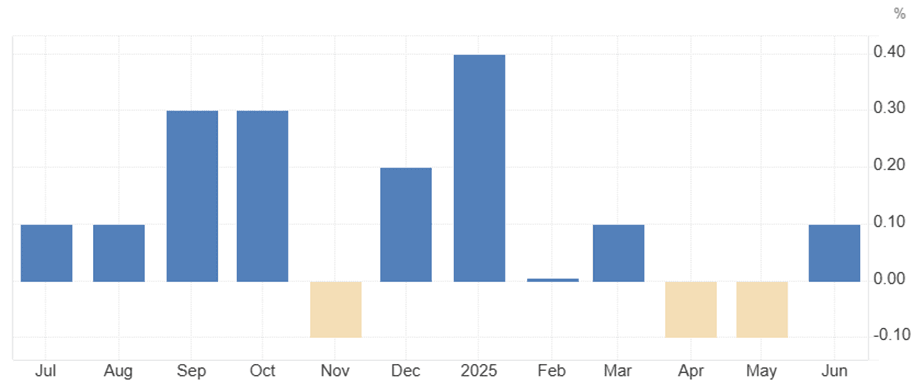

U.S. durable goods orders fell sharply by 9.3% in June, while July orders are expected to decline by a more moderate 2.5%. The smaller contraction forecast reflects expectations that the June drop was largely driven by a steep pullback in volatile aircraft and defence orders, while underlying demand in core categories such as machinery, electronics, and vehicles remains relatively resilient. Nonetheless, higher borrowing costs and lingering economic uncertainty continue to cap business investment. This data is set to be released on 26 August at 1230 GMT.

(U.S. Durable Goods Orders MoM Chart, Source: Trading Economics)

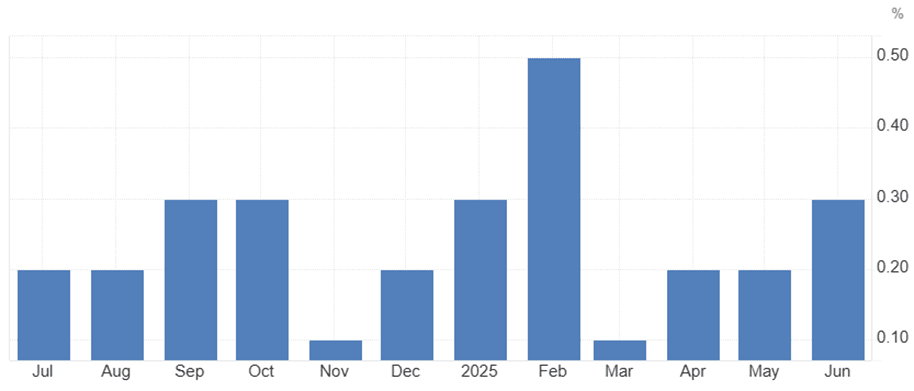

Australia’s monthly CPI indicator rose 1.9% in June, with July’s reading expected to edge up slightly to 2%. The anticipated increase reflects persistent price pressures from housing, utilities, and services, while elevated energy and food costs continue to feed into overall inflation. Although disinflationary trends are emerging in some goods categories, sticky services inflation keeps headline CPI under upward pressure. This data is set to be released on 27 August at 0130 GMT.

(Australia Monthly CPI Indicator Chart, Source: Trading Economics)

Top US company earnings: Nvidia (NVDA), RBC (RY)

The U.S. economy contracted by 0.5% in the first quarter of 2025, but growth is expected to rebound strongly to 3.0% in the second quarter. The sharp turnaround is driven by resilient consumer spending, a recovery in business investment, and government stimulus measures that helped offset the previous quarter’s weakness. Softer inflation and a steady labour market have also supported household demand, while easing supply chain pressures provided an additional boost to economic activity. This data is set to be released on 28 August at 1230 GMT.

(U.S. GDP Growth Rate QoQ Chart, Source: Trading Economics)

U.S. pending home sales fell 0.8% in June, while July’s decline is expected to narrow to just 0.2%. The smaller drop reflects signs of stabilising housing demand as buyers gradually adjust to higher mortgage rates, while limited supply continues to keep market activity subdued. Though affordability remains a challenge, steady job growth and moderating home price increases are helping cushion the pace of decline. This data is set to be released on 28 August at 1400 GMT.

(U.S. Pending Home Sales MoM Chart, Source: Trading Economics)

Top US company earnings: Alibaba (BABA), Dell Tech (DELL)

Canada’s GDP contracted by 0.1% in May, while June growth is expected to edge up slightly by 0.1%. The modest rebound reflects a cautious recovery, with gains in manufacturing, energy, and services likely offsetting lingering softness in construction and trade. While consumer spending and a strong labour market provide some support, higher interest rates and elevated costs continue to restrain overall economic momentum, keeping the growth outlook subdued. This data is set to be released on 29 August at 1230 GMT.

(Canada GDP MoM Chart, Source: Trading Economics)

The U.S. core PCE price index rose 0.3% in June, with July’s increase expected to ease to 0.2%. The softer projection reflects signs of cooling inflation as goods prices stabilise and wage growth moderates, while easing supply chain pressures help cap cost increases. However, persistent price stickiness in services means inflation is slowing only gradually, keeping the Federal Reserve cautious about the timing of future policy adjustments. This data is set to be released on 29 August at 1230 GMT.

(U.S. Core PCE Price Index MoM Chart, Source: Trading Economics)

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.