수요일 Apr 9 2025 09:13

4 분

The Reserve Bank of New Zealand (RBNZ) cut interest rates as anticipated on Wednesday, today, responding to a continued decline in inflation and worsening domestic economic conditions, particularly amid rising U.S. trade tariffs. The central bank lowered its official cash rate by 25 basis points to 3.5%, marking its fifth rate cut since launching an easing cycle in mid-2024.

The RBNZ cited “downside risks to the outlook for economic activity and inflation in New Zealand,” attributing part of the uncertainty to escalating global trade barriers, an apparent reference to new U.S. import tariffs introduced by U.S. President Donald Trump. The central bank signalled it remains open to further rate reductions, depending on how the full impact of these tariffs unfolds. It also emphasised that future monetary policy decisions will be guided by the medium-term inflation outlook.

(NZD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the NZD/USD currency pair has been in a bearish trend since the end of September 2024. It began to rebound and has been moving within an ascending channel since early January 2025, as indicated by a series of higher highs and higher lows. However, a significant bearish move has broken below the channel. The pair is currently retesting the swap zone at 0.5560 – 0.5580. If it fails to break above this zone in the near term, the solid bearish structure could potentially push the rate lower, forming a new lower low.

Crude oil futures fell to under $58 per barrel on Wednesday, today, marking a fifth consecutive session of losses amid growing concerns that aggressive U.S. tariffs could trigger a global recession and dampen energy demand. Since April 2, crude oil futures have lost almost 20% of their value, pressured by weakening demand projections and increasing production levels.

Adding to market anxiety, President Trump’s sweeping new tariffs, including a steep 104% levy on Chinese imports, are set to take effect later today. Although the White House has signalled a willingness to engage in trade talks, China has vowed to "fight to the end," raising the prospect of a prolonged and disruptive trade conflict.

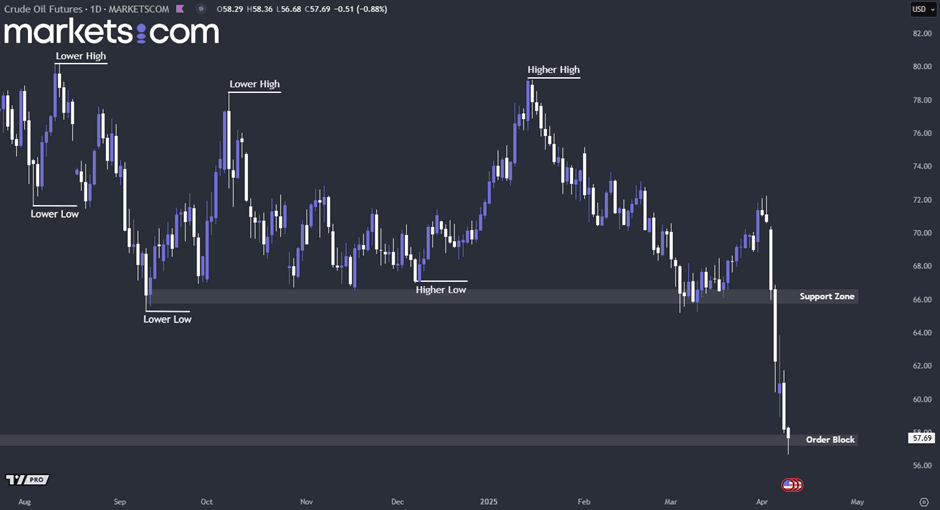

(Crude Oil Futures Daily Chart, Source: Trading View)

From a technical analysis perspective, the recent price action of crude oil futures has broken below the support zone of 65.80 – 66.50 solidly, confirming the current bearish structure. It is now retesting an order block at 57.20 – 57.80. If this order block fails to support the price, it may potentially continue to decline further, forming another lower low.

Tesla CEO Elon Musk has launched a scathing rebuttal against Trump trade adviser Peter Navarro, who criticised Tesla as merely an assembler reliant on foreign parts and dismissed Musk’s advocacy for zero tariffs as self-serving. Musk fired back on X, defending Tesla’s deep manufacturing roots in the U.S., particularly in California and Texas, and its highly integrated operations while mocking Navarro’s intelligence and credentials. The clash underscores a deeper divide between pro-trade business leaders like Musk and protectionist policymakers like Navarro, at a time when many CEOs warn that tariffs risk tipping the U.S. economy into recession.

(TSLA Share Price Daily Chart, Source: Trading View)

From a technical analysis perspective, the share price of TESLA has been in a bearish trend since mid-December 2024, as indicated by lower highs and lower lows. Currently, the price is retesting the order block at 213 – 223. If this order block fails to support the price, it may continue to drop, potentially retesting the support zone at 170 – 182. Conversely, if the price can rebound from this order block zone, it may surge upwards to retest the swap zone at 273 – 285.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.