You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

월요일 Aug 25 2025 08:25

5 분

The U.S. dollar index (DXY) fell 0.90% on Friday, retreating from a 1.5-week high to a 3.5-week low after dovish remarks from Fed Chair Powell. Powell highlighted increasing downside risks to employment and suggested that the shifting balance of risks may call for adjustments to monetary policy. Falling U.S. Treasury yields also pressured the greenback, with the 10-year T-note yield slipping to a one-week low of 4.24%.

The dollar initially rose during the Asian trading session following hawkish remarks from Boston Fed President Susan Collins, who maintained that a modestly restrictive policy remains appropriate. However, concerns over Fed independence later weighed on sentiment after President Trump stated he would dismiss Fed Governor Lisa Cook if she refused to resign amid mortgage fraud allegations.

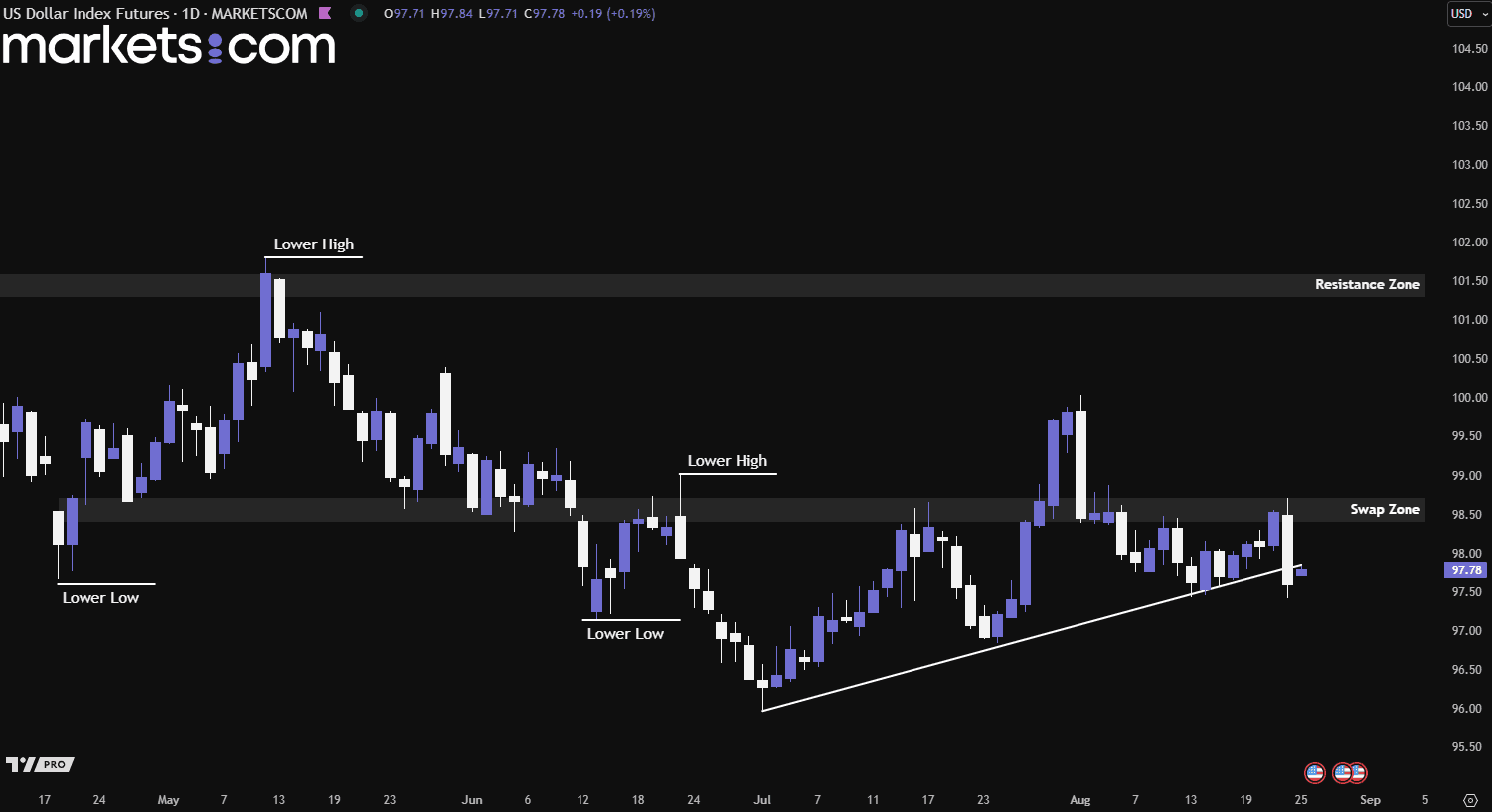

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. dollar index has been rejected from the swap zone of 98.40 – 98.70 last Friday, driving the pair lower and even breaking below the upward trend line. Such valid bearish momentum might indicate the pair could be initiating another round of bearish movement, starting its lower highs and lower lows cycle again, driving the pair further lower.

Gold prices held firm near $3,375 per ounce last Friday, supported by expectations of a dovish Federal Reserve pivot and strong perceived safe-haven demand. Fed Chair Jerome Powell highlighted rising labour market risks and persistent inflation concerns, signalling a likely 25 bps rate cut in September. Traders also priced in the possibility of three total cuts this year, bolstering the appeal of non-yielding precious metals.

On Monday, gold eased to around $3,360 at the time of writing, following a 1% gain in the prior session, as the U.S. dollar attempted to recover. Powell’s Jackson Hole speech reinforced expectations of monetary policy adjustments. At the same time, escalating tensions between Russia and Ukraine, marked by Moscow’s largest drone and missile attack in over a month and renewed accusations against Kyiv, continued to support gold’s perceived safe-haven demand.

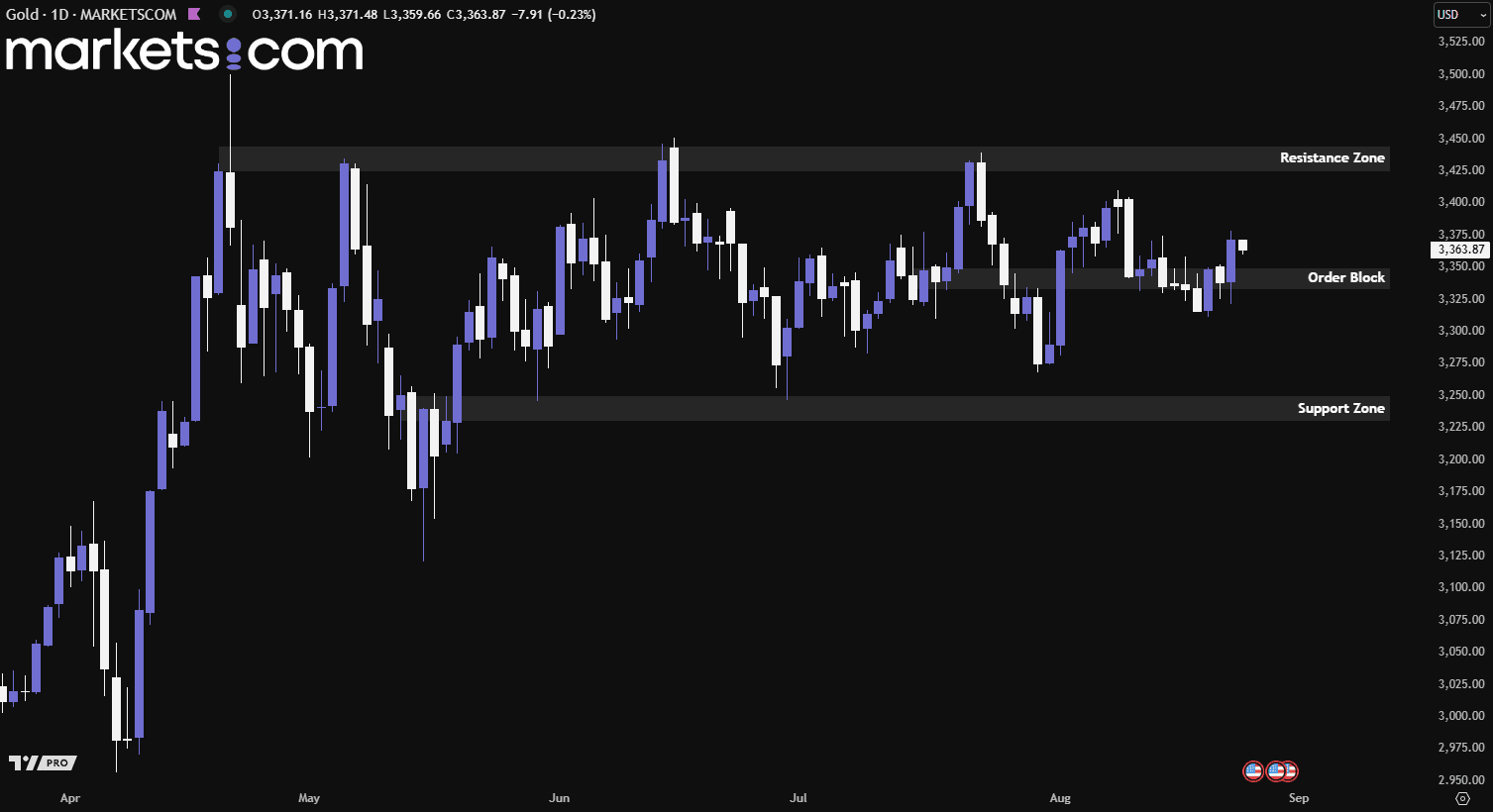

(Gold Daily Price Chart, Source: Trading View)

From a technical analysis perspective, gold has found support within the order block of 3,333 – 3,350 and managed to close above it last Friday with strong bullish momentum. This valid bullish structure could potentially drive the price higher, retesting the next psychological level and the daily bearish engulfing area around $3,400.

The European Central Bank (ECB) is expected to keep interest rates steady in September, with a potential rate cut on September 11 seen as unlikely unless incoming data, such as August’s flash inflation or economic activity surveys, show a sharp deterioration. ECB President Christine Lagarde previously said the bank was "in a good place" after holding the key rate at 2% in July, effectively pausing its year-long cutting cycle. Recent data show the eurozone economy has been more resilient than expected, while inflation remains near the ECB’s 2% target.

Looking ahead, discussions about further monetary easing may return later this year, particularly at the October 30 and December 18 meetings, if the economy weakens or U.S. tariffs begin to pressure euro zone exports. Current projections foresee inflation dipping below the 2% target next year before rebounding. Moreover, tariffs imposed by the Trump administration, set at 15% for most EU goods, were largely in line with ECB expectations and have so far avoided worst-case scenarios.

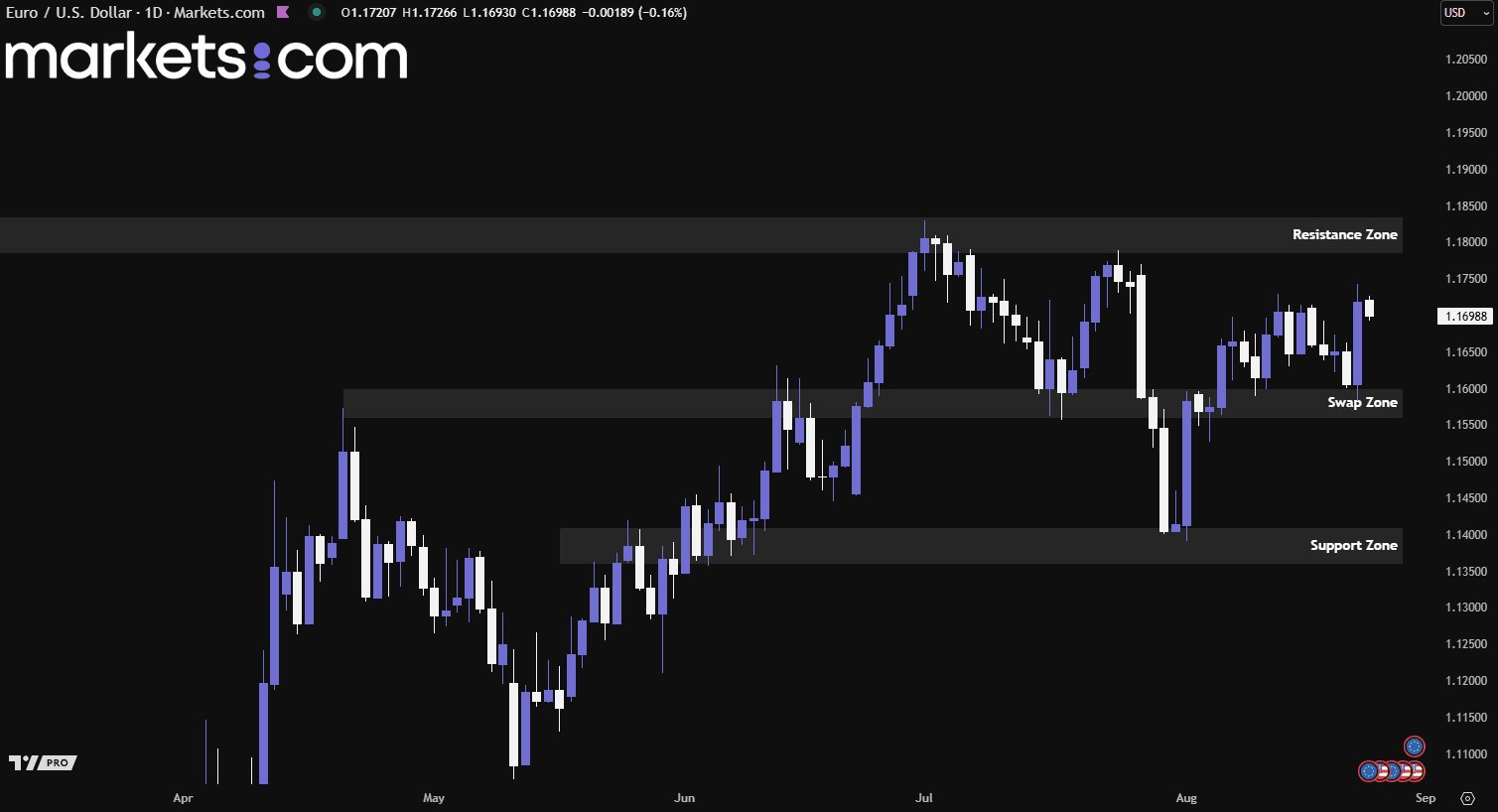

(EUR/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the EUR/USD currency pair has found support at the 1.1560 – 1.1600 swap zone, surging upward with strong bullish momentum. This valid bullish movement could potentially drive the pair higher, retesting the resistance zone of 1.1785 – 1.1835. Furthermore, the strong bullish pressure preventing a break below the swap zone may also lead the pair to consolidate between the resistance and swap zones, with a clearer direction expected once either zone is broken.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.