You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

목요일 Aug 7 2025 06:44

6 분

The Bank of England appears set to cut interest rates for the fifth time in a year this Thursday, likely lowering the Bank Rate from 4.25% to 4% in response to a slowing labour market, compounded by recent employer tax hikes and global trade tensions led by U.S. President Trump. Governor Andrew Bailey and most of the Monetary Policy Committee (MPC) are expected to back the cut, but the decision may once again split the panel. Two members could push for a deeper cut to support growth, while another two may resist any reduction due to persistent inflation risks, mirroring the divided stance seen in May.

Investors will be closely watching whether the BoE maintains its "gradual and careful" stance on rate adjustments, a signal many economists have interpreted as one cut per quarter. However, that cautious outlook is under pressure. Inflation is now running higher than the BoE's projections. It is forecast by some to hit 4%, double the 2% target, raising doubts about how long the central bank can keep easing without losing credibility.

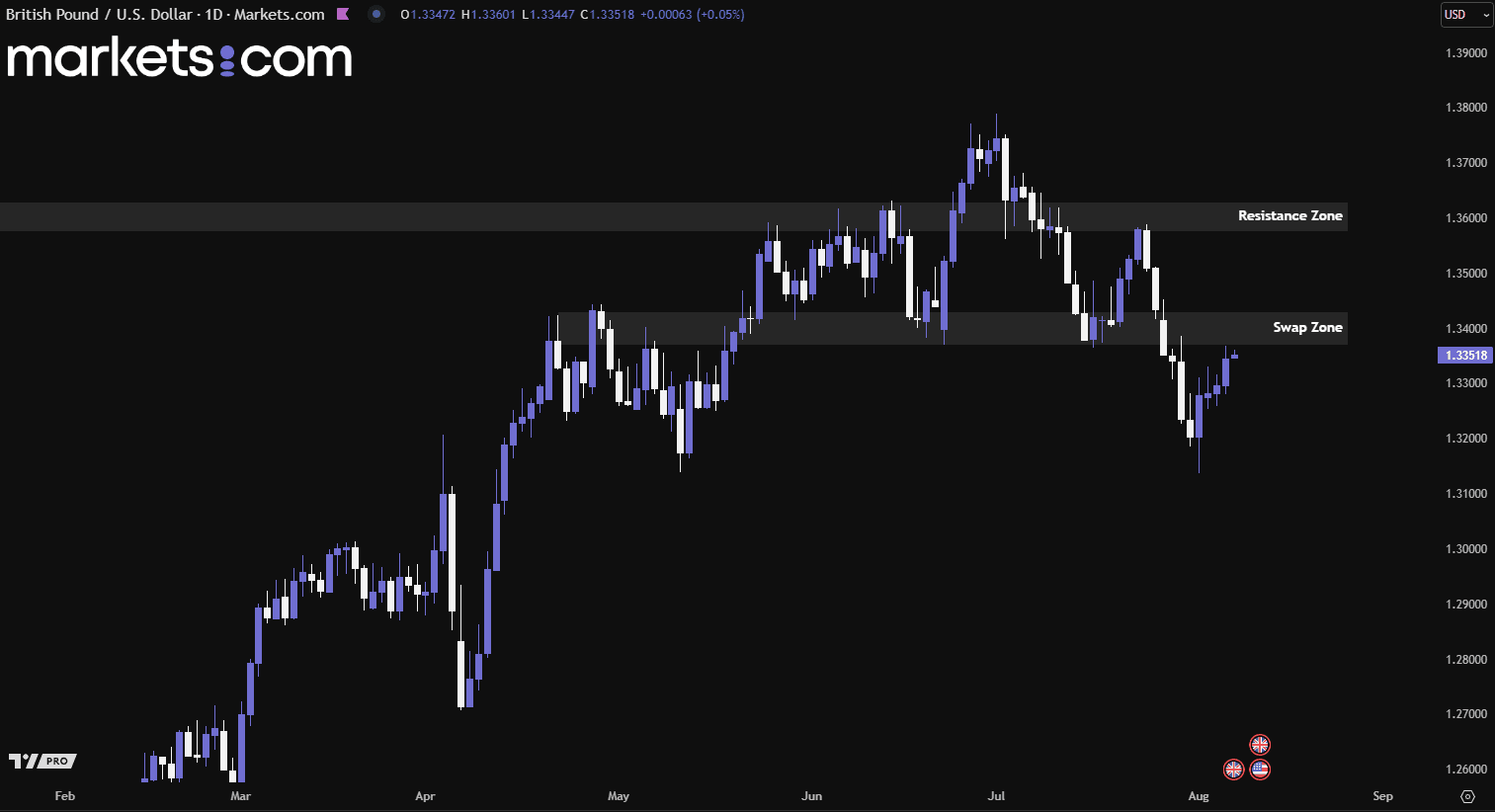

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/USD currency pair has been in a bullish trend since mid-January 2025, as indicated by the formation of higher highs and higher lows. However, it began to exhibit bearish movement in early July, as indicated by the lower highs and lower lows.

Initially, the pair broke below the resistance zone of 1.3580 – 1.3630, found support at the swap zone of 1.3370 – 1.3430, and then surged back up to retest the resistance zone. However, it was rejected, dropped lower, and broke below the swap zone. Currently, the pair is rising again and approaching the swap zone, potentially to retest it. If it faces rejection at this level, strong bearish momentum may drive the pair lower.

The U.S. dollar weakened on Wednesday while the euro rose to a one-week high, as markets ramped up expectations for more Federal Reserve rate cuts this year. Following Friday’s weaker-than-expected July jobs report, traders now see a 95% chance of a 25-basis point cut in September, up from 48% a week earlier, according to CME’s FedWatch Tool. In total, markets are pricing in 62 basis points of cuts by year-end, with no major U.S. data releases midweek to shift sentiment.

Minneapolis Fed President Neel Kashkari suggested the Fed may soon need to lower rates to support the slowing economy, although uncertainty remains over whether tariffs will keep driving inflation. On the same day, President Trump signed an executive order adding a new 25% tariff on Indian imports, accusing the country of indirectly buying Russian oil. This adds to the existing 25% tariffs and could further complicate the Fed’s policy outlook.

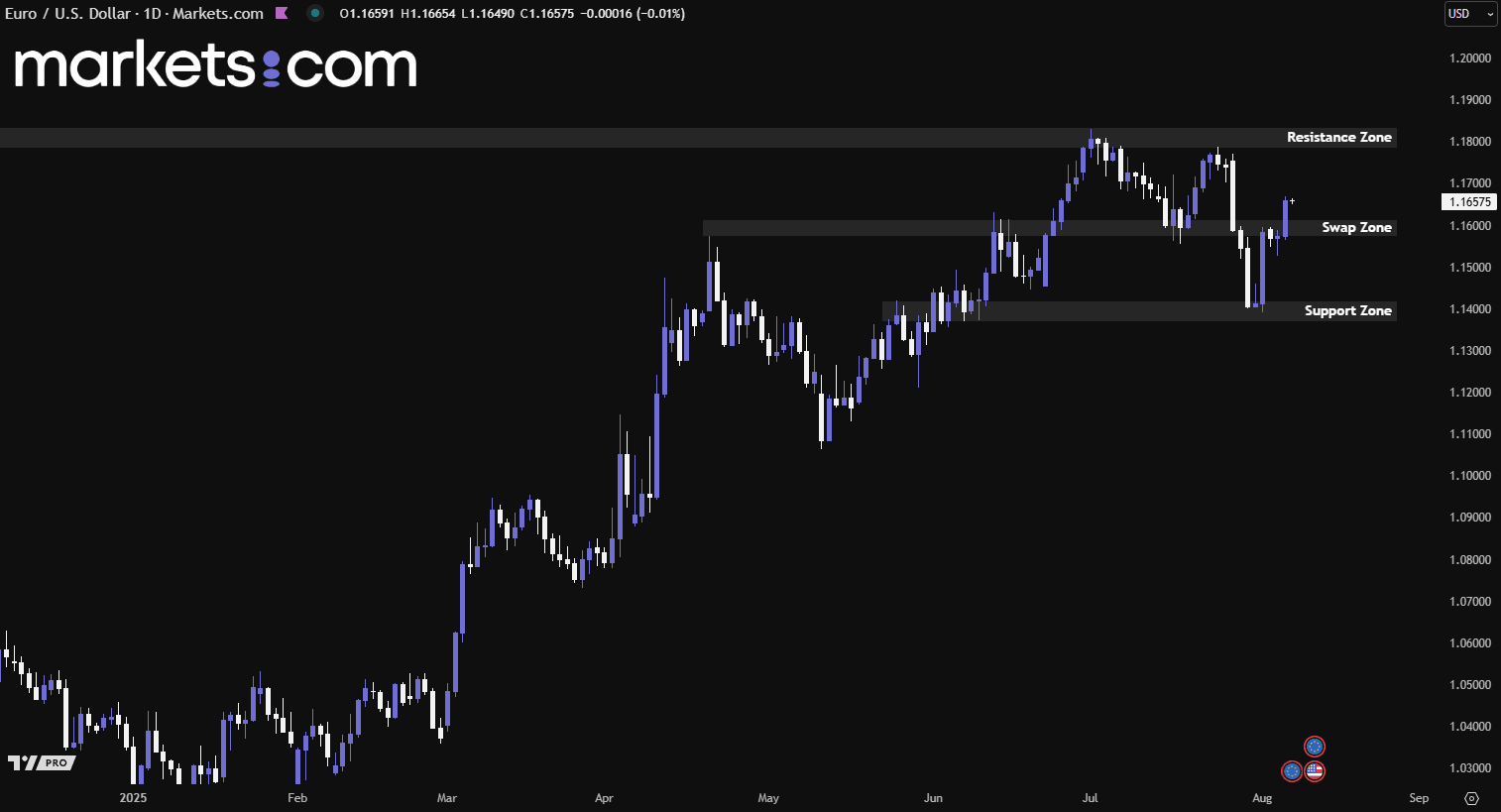

(EUR/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the EUR/USD currency pair was rejected from the resistance zone of 1.1785 – 1.1835, dropped lower, and found support at the 1.1370 – 1.1420 zone. It then surged upwards and broke above the swap zone of 1.1575 – 1.1615. This valid bullish movement may potentially continue to drive the pair higher to retest the resistance zone.

Bank of Japan policymakers should proceed cautiously with interest rate hikes, given the potential economic drag from higher U.S. tariffs, said Ken Saito, a key figure in the ruling Liberal Democratic Party (LDP). He warned that increased U.S. levies could weaken corporate profits, especially in the auto sector, and undermine wage growth, casting doubt on the BOJ’s expectations of a sustained inflation-wage cycle. Saito emphasised that Japan's fragile recovery, following decades of stagnation and low inflation, makes any tightening of monetary policy particularly risky.

Saito also called for Prime Minister Shigeru Ishiba to resign after the LDP’s recent election victory, urging the party to seek a third coalition partner under new leadership. He rejected opposition proposals to cut the national sales tax, arguing that Japan should instead pursue pro-growth policies to foster a virtuous cycle of wage and price increases.

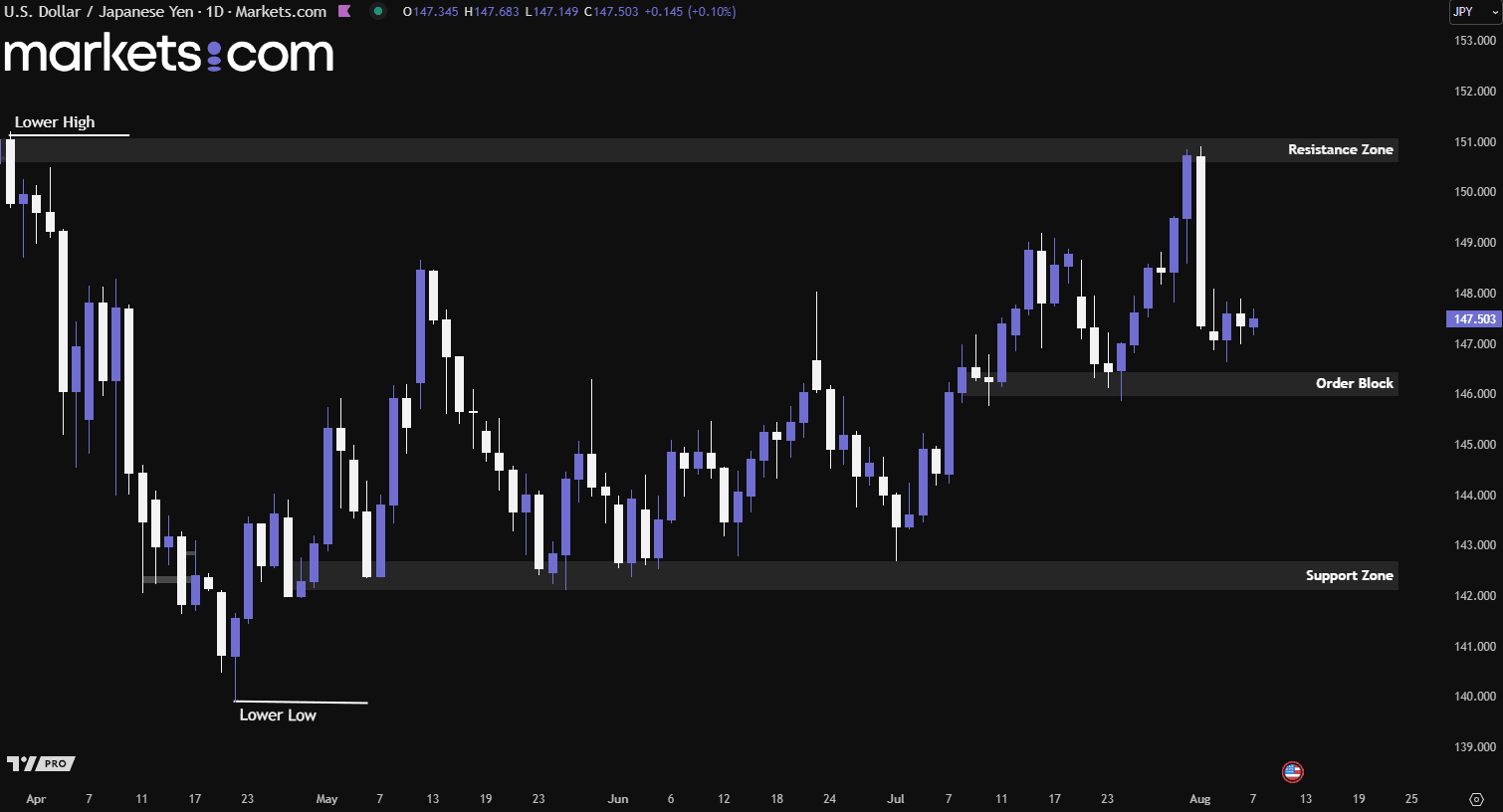

(USD/JPY Daily Chart, Source: Trading View)

From a technical analysis perspective, the USD/JPY currency pair was rejected from the resistance zone of 150.60 – 151.10, dropped lower, and has been consolidating since Monday. It may potentially decline further to retest the order block at 145.95 – 146.45, collect liquidity from this zone, and determine its next direction. If it manages to find support there, the pair could resume its bullish movement and surge upwards.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.