Rabu Sep 2 2020 13:34

4 min

September 2nd saw an important development as betting markets turned in favour of Donald Trump being re-elected. The RCP average showed Trump +0.1pt over Biden at 49.8 to 49.7. Whilst clearly too close to call, the speed at which Trump has narrowed the gap shows how quickly things can change.

Betting markets are not, however, the same as polls. They are only market participants’ best guess at what the outcome will be.

But polls also show a tighter race. Our US election poll tracker, which is powered by data from Real Clear Politics, has come in sharply. On a national level Trump is polling better than at any time since May and has eaten into Biden’s clear lead, which remains strong.

However, looking into the key battlegrounds where we know the fight will be bitterest and where it really counts, the lead Biden has is also narrowing and now well within the margin for error area. The latest RCP data shows Biden at +2.6 in the top battlegrounds, having been more than +6pts in July. Trump currently stands on 45.4 vs Biden’s 48.

The tighter race is being displayed by more implied volatility in options markets for the S&P 500 than the stock market itself is showing. We have talked in the last few days about the Vix moving steadily higher even as the SPX rises – futures again pointing higher today after Tuesday’s record close.

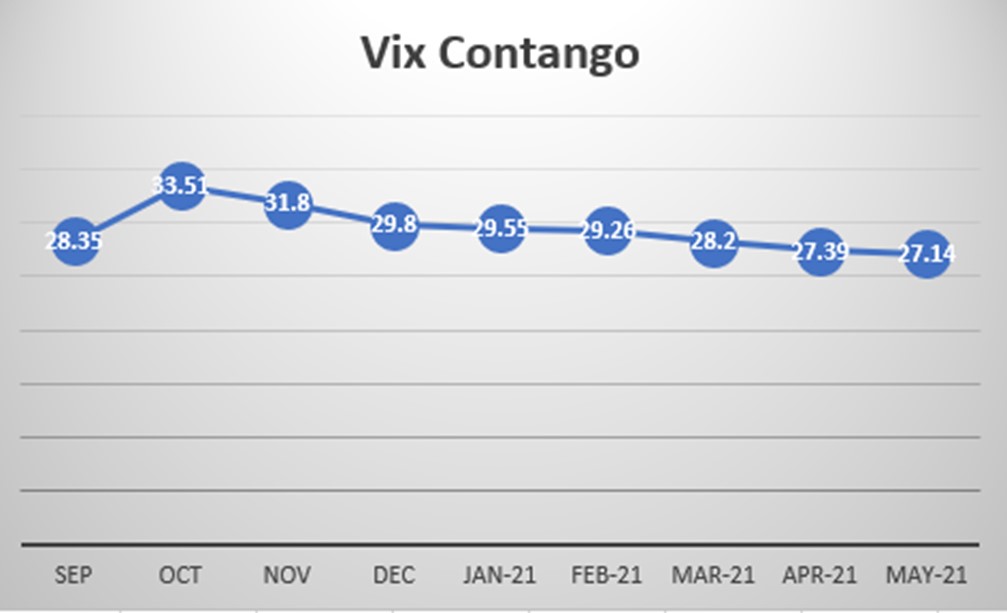

This is the first red flag. The second is the term structure of the Vix futures curve which shows significant increase in expected volatility come Oct and Nov with a sharp 20% contango between the front and back months. Compare for example the CBOE Volatility Index Oct 2020 close at 33.51 vs the front month (Sep) at 28.35. Nov traded at 31.80.

This contango in the Vix is at odds with the general grind higher we are seeing and signals genuine anxiety among investors that the election will create the conditions for pullback.

Our Trump20 Blend – comprised of stocks seen as being most exposed to changes to corporate tax rates – is up but has lagged the broad market in recent days, whilst the dollar has softened despite a decent recovery on Wednesday.

Funnily enough, whilst the implied volatility is elevated around the election, all else being equal Trump’s low-tax, low-regulation agenda ought to be more positive for the stock market than a Democrat clean sweep would be. What this increased volatility may represent more is in fact investor fears about a disputed election result, which would considerably dent risk appetite going into the end of the year.