Financial trading basics: In the world of financial trading, emotions can have a powerful impact on decision-making.

One of the most common and challenging emotions traders face is FOMO, an acronym for the "Fear of Missing Out." This feeling can lead to impulsive decisions, often resulting in unfavorable outcomes. Understanding what FOMO is, how it manifests in trading, and ways to control it is crucial for anyone looking to navigate the markets with discipline and clarity.

FOMO is the anxiety or fear that others are gaining an advantage or benefiting from a market move while you are not participating. This psychological phenomenon can cause traders to enter or exit positions hastily, driven by the worry that they might miss a chance to capitalize on a price movement or trend.

In trading, FOMO often arises when markets are moving quickly, and stories of gains spread rapidly. The pressure to act immediately can override careful planning or strategy, leading to impulsive trades that are not well thought out.

FOMO undermines the rational and disciplined approach required in trading. Here are some reasons why it can be damaging:

Impulsive Decisions

When driven by FOMO, decisions tend to be reactive rather than proactive. This lack of preparation increases the likelihood of errors and losses.

Overtrading

FOMO can lead to excessive trading activity, increasing transaction costs and exposing traders to unnecessary risks.

Emotional Stress

Constantly worrying about missing out creates emotional fatigue, which impairs judgment and can lead to burnout.

Deviation from Strategy

Trading strategies are developed based on analysis and risk management. FOMO pushes traders to deviate from their plans, often with negative consequences.

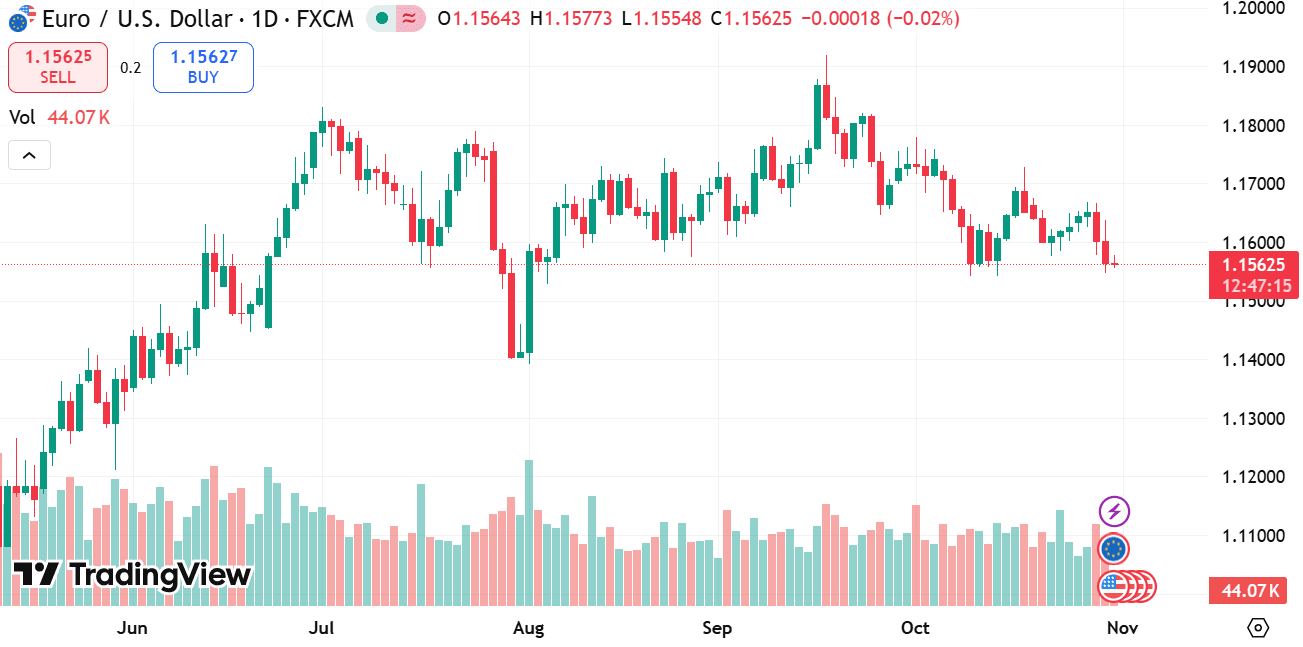

source: tradingview

Controlling FOMO requires a combination of mindset shifts, practical techniques, and disciplined habits. Below are key approaches to manage and reduce the influence of this emotion.

1. Develop a Clear Trading Plan

Having a well-defined trading plan helps anchor decisions in logic rather than emotion. Your plan should include:

Entry and exit criteria.

Risk management rules, including maximum acceptable losses.

Position sizing guidelines.

Criteria for evaluating trades.

When you have a plan, it becomes easier to say no to impulsive moves that do not fit your strategy.

2. Set Realistic Expectations

Understand that no one catches every move perfectly. Markets are unpredictable, and missing some trades is part of the process. Accepting this reality reduces the pressure to act hastily.

3. Use Predefined Risk Controls

Risk controls such as stop-loss orders and position limits automatically enforce discipline. They help prevent emotional decisions by limiting potential damage if the market moves against you.

4. Practice Patience and Discipline

Waiting for setups that meet your criteria is essential. Patience allows you to avoid chasing after every market move. Remind yourself that quality matters more than quantity in trading.

5. Maintain Emotional Awareness

Recognize when FOMO is influencing your thoughts or behavior. Mindfulness techniques, journaling your feelings, or taking breaks can help you stay grounded.

6. Focus on the Process, Not the Outcome

Concentrate on following your trading plan and executing your strategy well. Detaching from the need for immediate results reduces anxiety about missing out.

7. Limit Market Exposure

Constantly watching the markets can heighten FOMO. Set specific times to review markets and avoid over-monitoring, which often triggers emotional reactions.

Learn from Experience

Review past trades to identify moments when FOMO influenced your decisions. Understanding those cases helps you recognize similar patterns in the future.

Keep a Trading Journal

Document your trades, reasons for entering or exiting, and emotional state during each trade. This practice increases self-awareness and accountability.

Build Confidence Through Education

The more you understand markets and trading principles, the less likely you are to be swayed by market noise or hype.

Surround Yourself with Supportive Community

Engage with trading peers or mentors who emphasize discipline and strategy over chasing every move. Constructive discussion can reinforce good habits.

Conclusion

FOMO is a natural human feeling intensified by the fast-paced and often unpredictable nature of financial markets. While it can drive traders to act quickly, unchecked FOMO often results in poor decisions and unnecessary risks.

By developing a clear trading plan, managing expectations, practicing discipline, and cultivating emotional awareness, traders can reduce the influence of FOMO. Controlling this emotion leads to more consistent decision-making and a healthier trading experience overall.

Remember, trading is a journey that rewards thoughtful preparation and patience more than impulsive reactions. Keeping FOMO in check is a critical step toward navigating the markets with greater clarity and confidence.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.