EURUSD long-term forecast: The EUR/USD currency pair, representing the exchange rate between the euro and the U.S. dollar, is among the most watched and traded pairs in the global foreign exchange market.

Its movements reflect the economic, political, and monetary dynamics between the Eurozone and the United States. Looking ahead to 2030, the trajectory of this pair will depend on a complex interplay of factors that shape both regions and influence their currencies. This article explores those factors and offers insights into what the future may hold for the euro against the U.S. dollar over the next several years.

The long-term outlook for EUR/USD is closely tied to the relative economic performance of the Eurozone and the United States. Growth trends, productivity, fiscal policies, and demographic developments all contribute to shaping the exchange rate environment.

Economic Growth and Productivity

Sustained economic growth in either region tends to strengthen that region’s currency due to increased demand for its assets and higher confidence in its economy. For the euro, the trajectory depends on the ability of Eurozone countries to foster innovation, improve productivity, and maintain cohesive economic policies despite the diverse nature of the union.

The U.S. economy’s growth path, fueled by technological advancements and consumer spending patterns, will also weigh heavily on the dollar’s strength. Changes in employment, manufacturing, and service sectors within both regions will affect trade flows and capital movements, key drivers of currency fluctuations.

Fiscal and Monetary Policies

Fiscal discipline and monetary policy direction are among the most critical elements impacting EUR/USD over the long run. Central banks in both the Eurozone and the U.S. influence the pair through interest rate decisions, quantitative easing, and other monetary tools.

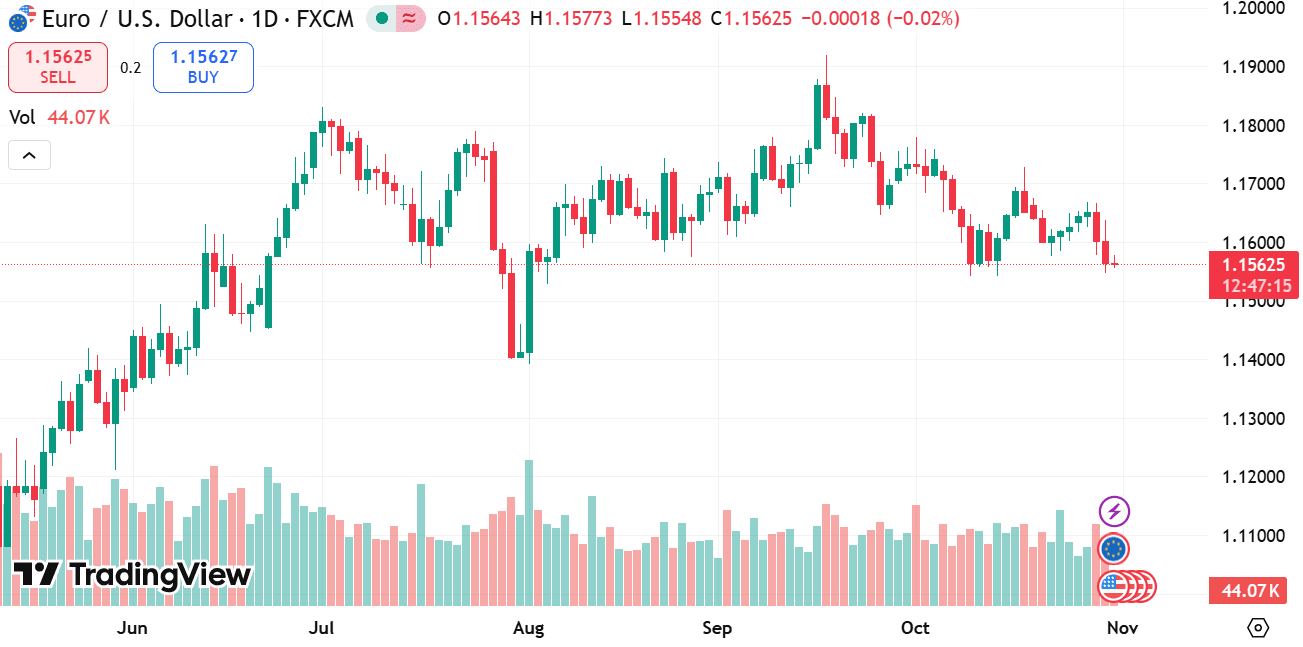

source: tradingview

The European Central Bank’s approach in balancing inflation control with growth support will shape the euro’s appeal globally. Meanwhile, the Federal Reserve’s policies to manage inflation and economic stability will influence the dollar’s relative value.

Differences in policy stance, such as tightening in one region while easing in another, can lead to shifts in exchange rates. Coordination or divergence between these policies will remain a key factor.

Political and Geopolitical Factors

The political landscape within the Eurozone and the United States will continue to play a role in currency valuation over the coming decade.

European Union Cohesion

The strength of the euro depends partly on the political unity of member states. Challenges such as fiscal integration, migration policies, and regulatory harmonization impact confidence in the euro as a common currency. Any political fragmentation or new crises could weigh on the euro’s outlook.

Conversely, deeper integration efforts and successful management of internal differences can bolster the euro’s standing on the world stage.

U.S. Political Environment

The dollar’s value is sensitive to shifts in U.S. domestic policies, including trade relations, fiscal spending, and foreign policy decisions. Political stability and the ability to manage internal divisions affect market perceptions and currency movements.

Trade policies and diplomatic relations with other global powers will also influence capital flows and the dollar’s relative position.

Global Geopolitical Dynamics

Broader geopolitical tensions or alliances affect both currencies through shifts in risk sentiment and global trade. Events such as conflicts, sanctions, or multilateral agreements can create volatility and influence currency preferences.

Structural Changes and Innovations

The next decade may bring structural shifts that reshape currency markets and influence EUR/USD.

Innovations in finance, including digital currencies and blockchain technology, may alter how currencies are used and traded. Central bank digital currencies (CBDCs) are being explored by both the ECB and the Federal Reserve, potentially impacting currency accessibility and cross-border payments.

Technological progress in industries and services can also affect economic competitiveness and thus currency strength.

Climate and Energy Transitions

Efforts to address climate change and transition to renewable energy sources could affect economic structures in both regions. The Eurozone’s commitment to green policies and sustainable finance initiatives may influence capital allocation and economic growth patterns.

The U.S. approach to energy production and environmental regulation will also be a factor in shaping economic fundamentals and currency dynamics.

Market Sentiment and External Influences

Market sentiment plays a role in currency movements through perceptions of risk and stability.

Risk Appetite and Global Market Conditions

Periods of heightened uncertainty or market stress often lead to shifts in currency demand. While the U.S. dollar has historically been seen as a preferred currency during turbulent times, evolving global conditions and changes in economic fundamentals could alter such patterns.

Trade Balances and Capital Flows

Trade deficits or surpluses between the Eurozone and the U.S. influence demand for each currency. Capital flows driven by portfolio allocations, foreign direct investment, and other financial transactions also impact exchange rates.

These external factors, while sometimes unpredictable, feed into the overall supply and demand dynamics for EUR/USD.

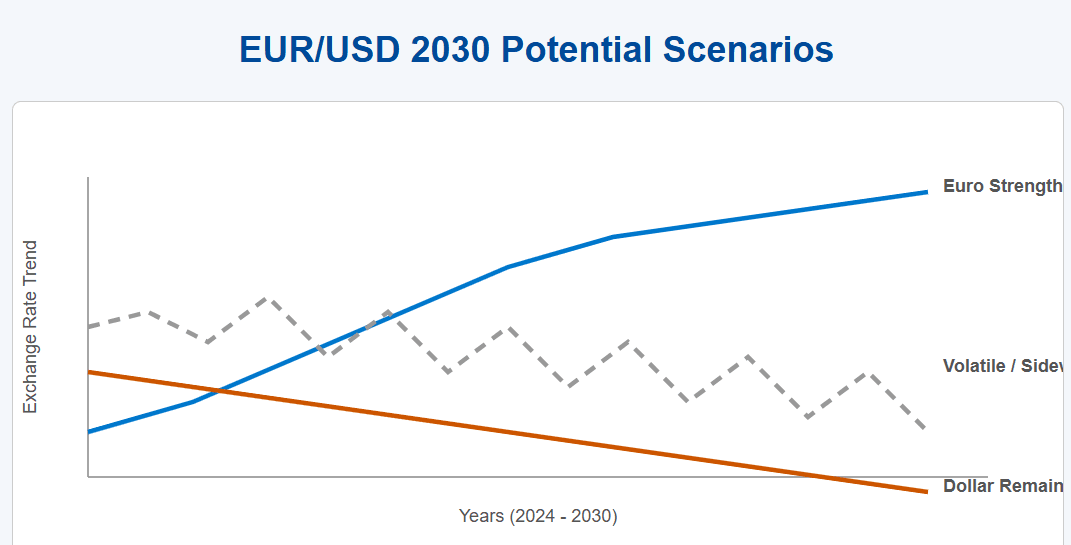

The euro to U.S. dollar exchange rate in 2030 will result from the interplay of economic growth trends, monetary and fiscal policies, political developments, structural changes, and global market sentiment.

If the Eurozone continues to deepen integration, foster innovation, and manage economic challenges effectively, the euro could maintain or strengthen its position relative to the dollar. However, political disruptions or lagging economic reforms may weigh on its prospects.

The U.S. dollar’s trajectory will depend on the Federal Reserve’s policy effectiveness, economic resilience, and the political environment. Shifts in global trade and geopolitical relations will also influence its standing.

Technological advancements and global challenges, such as climate change, may introduce new variables that reshape the currency landscape in unexpected ways.

Overall, the EUR/USD pair is expected to remain dynamic, reflecting the evolving realities of two major economic blocs. Participants in currency markets will need to keep abreast of these broad trends and adapt to changing conditions as the decade unfolds.

This long-term view emphasizes the complexity and interconnectedness of forces shaping the EUR/USD exchange rate. While precise predictions are inherently uncertain, understanding these drivers provides valuable context for anticipating potential directions by 2030.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.